- December 15, 2025

-

-

Loading

Loading

The retail commercial real estate sector, while not necessarily scorching hot, is, on a national level, outperforming competing sectors and expectations.

So much so that fact No. 1 in a recent report on the overall commercial real estate industry from left-leaning think tank Brookings states “Surprise! Retail was the most stable CRE category through the pandemic.”

Retail in particular is a surprising bright spot, with big opportunities for delivering positive economic and social returns,” states the report, entitled “Six facts about the post-pandemic commercial real estate market in the U.S. and what they tell us about the future of retail.”

Released Aug. 14, the report uses and analyzes data from real estate analytics firm CoStar.

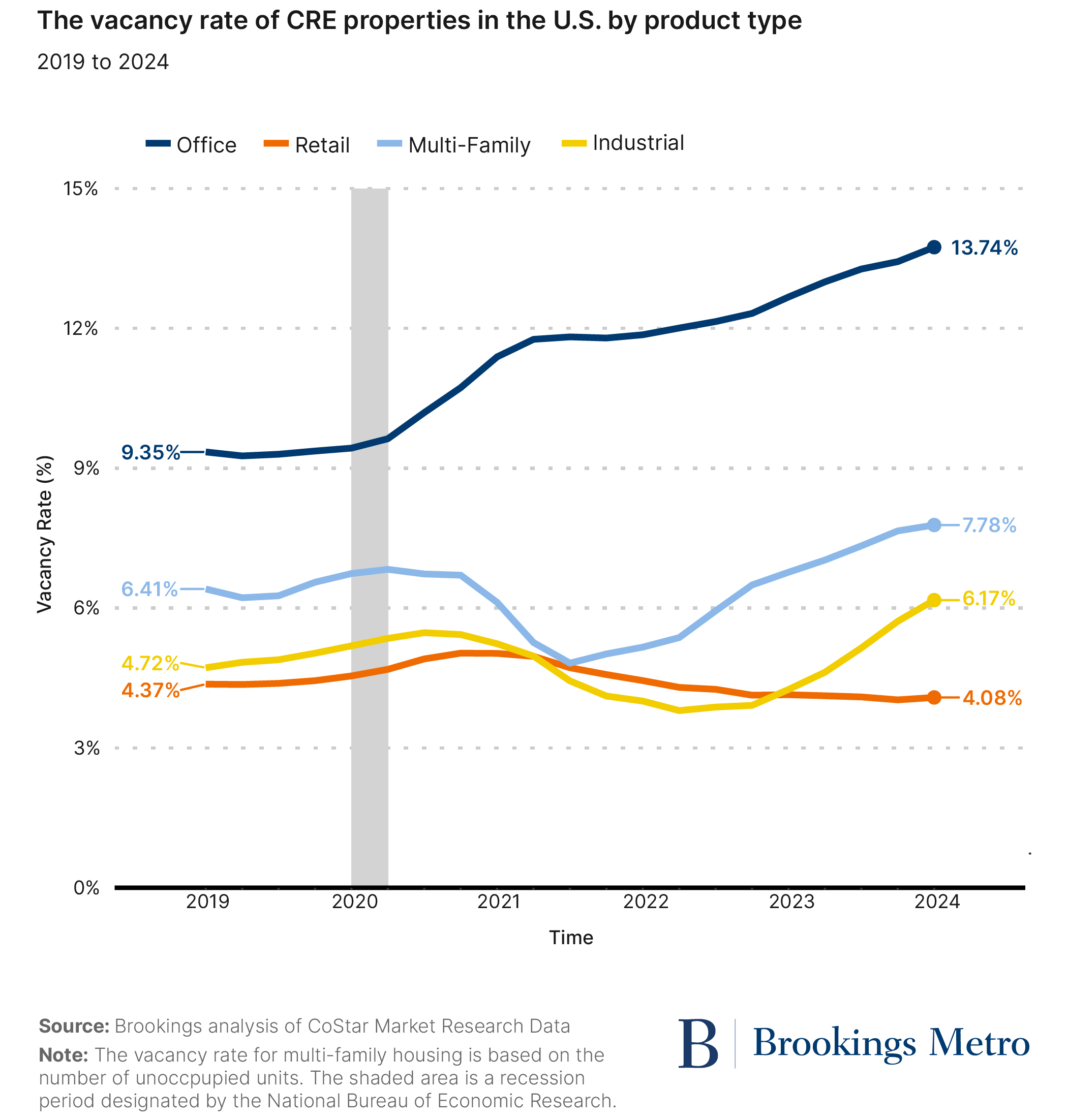

Retail space, for one, has the smallest gap between supply and demand among all four major sectors: multifamily, office, retail and industrial. The demand for office space has decreased by 160 million square feet nationally since the first quarter of 2019, the report found. “And while demand for industrial space grew the most, an explosion in supply has produced higher aggregate vacancy for that product, leaving the retail market the tightest CRE category,” the report states.

Valuation was another strong showing for retail. For the first time since 2021, the sector, at $3.03 trillion, is No. 2 out of the big four in total asset value, behind multifamily. Yet unlike multifamily, retail, albeit slightly, has increased in value since 2019. Multifamily, which remains the No. 1 sector by a big margin, posted a $4.6 trillion valuation — down -23.3% from $6 trillion in 2021. Industrial was No. 3 at $2.91 trillion, followed by office, at $2.43 trillion.

More good news for retail comes from vacancy metrics. Retail, the report found, was “the only product type for which aggregate vacancy has declined since 2019.” On that front, the vacancy rate dropped from 4.37% to 4.08%.

Not much of a surprise but yet painful for office landlords is the rise in vacancy rates in that sector: 9.35% to 13.74%.

It’s not only the Brookings report that detailed the retail sector’s strengths. JLL’s second-quarter retail market dynamics report found that retail net absorption jumped 75.4% quarter-over-quarter to 7.7 million square feet in the most recent quarter. JLL found that was “due mostly to a reduction in move-outs as well as more space taken in community centers, lifestyle centers and Class C malls.”

Tenants are making decisions faster, the JLL report found, with the average months-to-lease dropping to a new low of 8.5 months. That in turn means “landlords are wielding much greater pricing power, often holding firm in rent negotiations,” the report states.

For specific tenants, JLL says small spaces dominated the second quarter, with multiple leases for quick-service restaurants such as Wingstop, Jersey Mike’s and Starbucks. “Markets in the South and Southwest continue to see some of the strongest rent gains,” the report found, “propelled by consumption-driven demand and population growth."