- April 11, 2025

-

-

Loading

Loading

Dealing for dirt: A 1,203-acre sod farm in Punta Gorda is on the market. The property is just off Highway 17, about eight miles from Interstate 75. The listing price is $3.9 million. But there’s a catch. The land itself isn’t for sale. According the listing from SVN Saunders Ralston Dantzler in Lakeland, what’s being marketed for sale is the “the operational assets of a substantial sod farm and the rights to a favorable lease agreement.” The assets include equipment, inventory and a customer base in need of sod for a growing residential market. According to Charlotte County property records, the land is owned by a McLean, Virginia LLC whose address matches Gladstone Commercial. The suburban Washington D.C. firm paid $7.35 million for the land in 2021.

Happy homes: Toll Brothers is building a new community on Oceana Way, just off of Collier Boulevard in Naples. The luxury homebuilder says the development, called Seven Shores, will be made up of 409 villas and single-family homes. It will include four collections with 36 total designs ranging from 1,600 square feet to 4,987 square feet. Prices start in the mid-$500,000s and top out at more than $1 million. The homes will be one and two stories and come with two to six bedrooms and two to six and a half bathrooms. The floor plans include lanais and smart home features with Wi-Fi thermostat and Wi-Fi garage control. A sales office has opened at 8876 Oceana Way with move-ins starting later this year or in early 2025.

Der Hotelier: The 90-room Comfort Inn & Suites Fort Myers Airport at 10091 Intercom Dr. has sold. It was bought by an LLC named RC Boatways Rd. which paid $10.5 million for the property. The address for the LLC, according to Lee County property records, is a 7,453-square-foot estate on the Caloosahatchee River, just north of the Gulf Harbour Yacht & Country Club. It belongs to Rolf and Heidi Lohbeck, records show. While that’s how it shows up in local property records, a German hotel company named Dr Lohbeck PrivatHotels claims ownership on its website. The chain, which is based in Schwelm, owns 23 hotels across Germany and Austria. It also owns seven U.S. hotel properties in Naples, Port Charlotte and Fort Myers. Lohbeck, on the company’s website, is described as an educator, writer, philosopher, hotelier and investor whose “unusual symbiosis of talents and skills also promotes an unconventional and creative corporate culture.” The Comfort Inn’s previous owner, Shivam Sakhyam LLC, paid $6.2 million for the hotel Dec. 2022.

Shopping for centers: A New York investment group has bought two Lakeland retail properties as part of an $180 million portfolio purchase that includes centers in three states and totals 1.5 million square feet. KPR Centers’ local purchases includes Lakeland Park Center, a 232,313-square-foot center at 919 Lakeland Park Center Drive and the Shoppes of Lakeland, a 174,439-square-foot center at 4019 U.S. Highway 98 N. Both are 100% percent leased with a combined tenant mix that includes Dick’s Sporting Goods, Ashley Furniture, Burlington and TJ Maxx. Both centers also have Target stores. KPR paid about $60 million for the two centers. Two other Florida properties were also part of the deal, one in Stuart and one in Jensen Beach. In all, KPR bought eight shopping centers in Wisconsin and Missouri along with the ones in Florida. The seller was RPT Properties.

Split deal: The New York owners of the majority of units at a Tampa condominium complex have obtained $10.5 million in financing. ESG Kullen will use the money “to further enhance the asset over their hold period,” says commercial real estate services firm Berkadia, which arranged the financing. ESG owns 141 of the 176 units at the Meridian Luxury Condominiums off of Hanley Road in Town ‘n Country. The financing, from Amerant Bank, is a two-year, floating-rate loan with 18 months of interest-only payments. Berkadia recently arranged financing for another fractured-condo owner in Town ‘n Country. In that deal it helped Axonic Properties secure a $32.23 million loan for its purchase of 246 units at Palmera Point.

Community hub: The redevelopment of a former public housing complex just off North Florida Avenue in the city's Tampa Heights neighborhood is getting an additional $4 million in federal funding to go toward a community center to be built on the site. That money is in addition to $2 million the Tampa Housing Authority has also committed for the project. Calling the 30,000-square-foot building a community center is selling it short, though. The Robles Park Smart Community HUB, as it will be officially known, is planned as an energy-efficient facility that will give about 20,000 local residents — in and out of the new community — access to social services as well as career education and technical training, mentoring programs, after school care and co-working space, along with access to financial services, mental and physical health services. The housing authority says it will be “equipped with cutting-edge technologies to minimize energy consumption and enhance community resilience.” The authority and city are redeveloping the 35-acre Robles Park Village community, which has fallen into disrepair over the past 60 years, into a 1,900-unit mixed-use housing development. That’s up from 433 units.

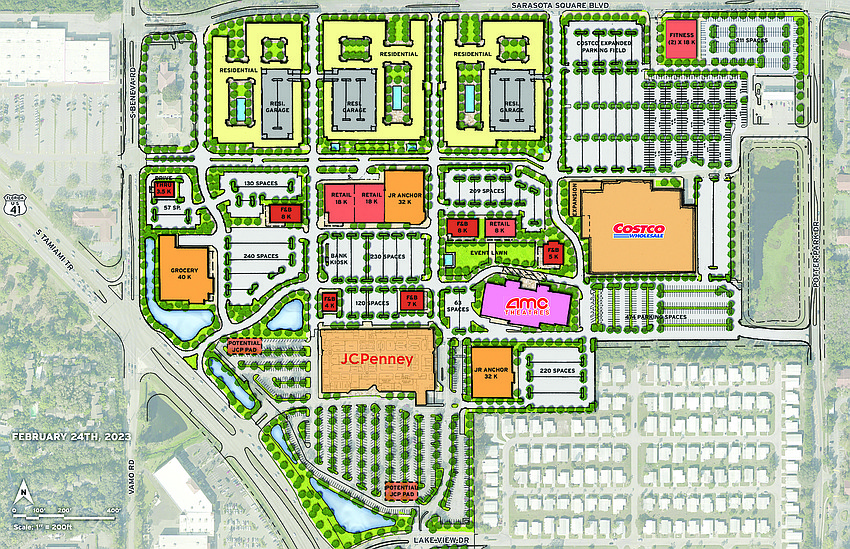

Out with the old: The Sarasota County Planning Commission unanimously recommended approval of five measures to pave the way for replacing Sarasota Square Mall and delivering up to 1,200 apartments to the site. According to the Sarasota Observer, sister paper of the Business Observer, the plans call for the mall building to be demolished and replaced by an open-air, multi-use center with high-end and fast-casual restaurants, specialty retailers and, possibly, medical offices. The planned changes will reduce commercial space from more than 1 million square feet to 692,457 square feet and allow for between 500 and 1,200 apartments to be built, the Observer says. Several outparcels, including Costco and JCPenney, would be staying under the plan. The developer, Illinois-based Torburn Partners, has spent $35.3 million on Sarasota Square properties, including the mall structure itself for $19 million in September 2021, in the past few years.

If you have news, notes or tips you want to pass along, contact LLLovio@BusinessObserverFL.com.