- December 16, 2025

-

-

Loading

Loading

Photo by JHVEPhoto

Photo by JHVEPhoto

Longtime Sarasota-Manatee area banker Neil McCurry recalls the heady days of the early and mid-2000s, when a banker rarely uttered the word “no” on the latest loan opportunity — especially in commercial real estate.

“Bankers were like ‘I don't want to lose a loan,’” to another bank, says McCurry, founder and CEO of People’s Community Bank and later CEO of Sabal Palm Bank, both in Sarasota. “I haven’t heard bankers talk like that today.”

McCurry is now Southwest Florida market executive of Stuart-based Seacoast National Bank, which acquired Sabal Palm in early 2022 in a $53.9 million deal. His outlook on the current banking market in the region, while opportunities are less robust than say, two years ago, is cautiously optimistic. Like several others in banking leadership positions in the region, McCurry’s tepid optimism is goosed by one core nugget: Florida remains a hot destination for people to move to and visit.

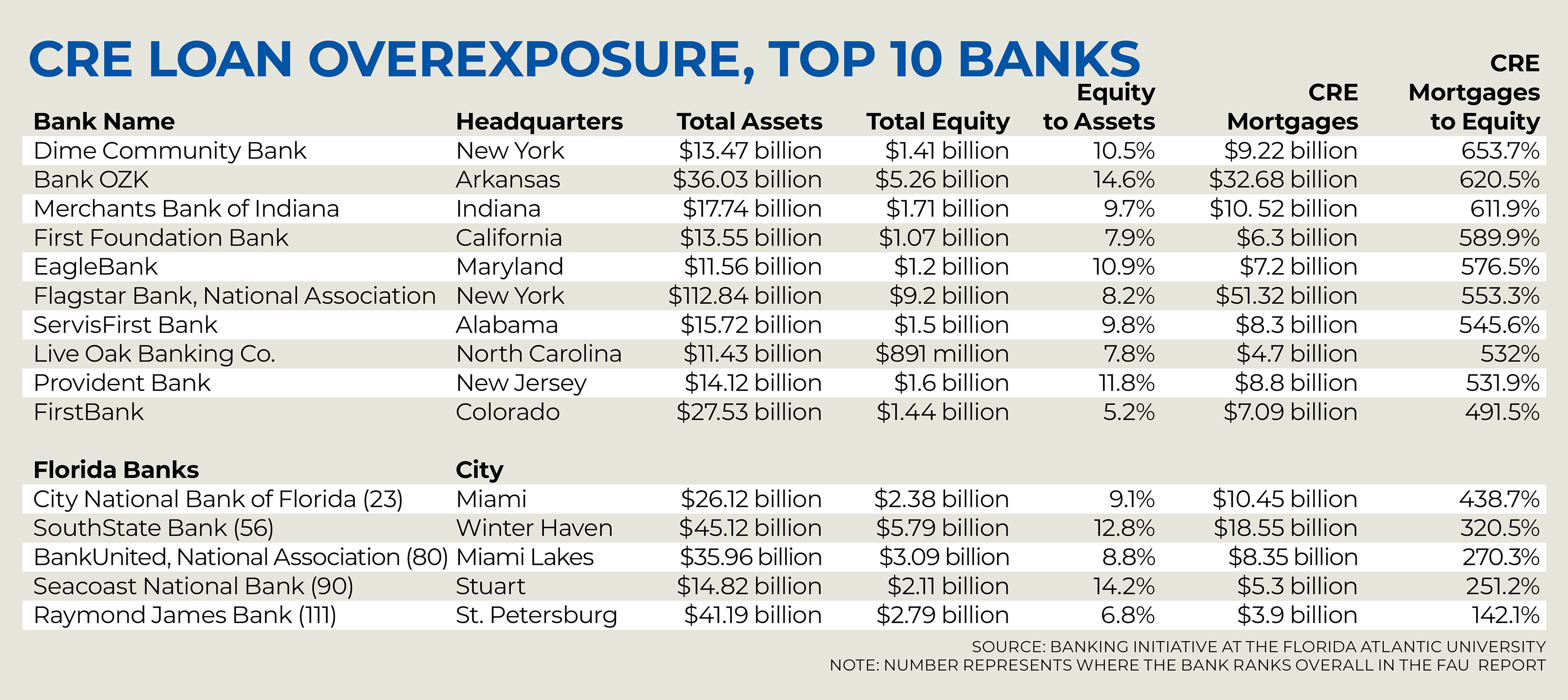

McCurry’s outlook differs widely from a new report from the Banking Initiative at Florida Atlantic University that looks at commercial real estate exposure among the 157 banks in the country with more than $10 billion in assets. The report, U.S. Banks’ Exposure to Risk from Commercial Real Estate, was released June 3. It found 67 of the 157 banks are “at increased risk of failure due to their commercial real estate (CRE) exposures.”

In data terms, those 67 banks have commercial real estate loan portfolios greater than 300% of total equity, according to first quarter 2024 regulatory data. The Federal Reserve says a ratio over 300% is considered excessive exposure, putting the banks at greater risk of failure.

“As most CRE mortgages are five-year balloon mortgages, many of these loans that originated in a lower rate environment in 2019 are currently rolling over and need refinancing this year when rates are well above 7%,” the report states. “The same concern carries over in 2025 for CRE loans originated in 2020, as well as 2026 for CRE loans originated in 2021.”

The report notes that while the big banks have big exposure, institutions under $10 billion in assets are also at risk. To wit: among banks of any size, 1,871 have total CRE exposures greater than 300%; 1,112 have exposures greater than 400%; 551 have exposures greater than 500%; and 243 have exposures greater than 600%.

“This is a very serious development for our banking system as commercial real estate loans are repricing in a high interest-rate environment,” FAU’s College of Business Lynn Eminent Scholar chaired professor of finance Rebel Cole says in a statement with the report. “With commercial properties selling at serious discounts in the current market, banks eventually are going to be forced by regulators to write down those exposures.”

The topic of commercial real estate loan overexposure also came up recently at a hearing in Congress, according to real estate analytics firm CoStar. “Supervisors and banks must remain vigilant and ready for expected and unexpected stresses, and presently there are several risks we are monitoring,” Federal Reserve Vice Chair for Supervision Michael Barr told Congress in an early June hearing, CoStar reports. “For example, delinquency rates are rising among certain commercial real estate loans, such as those backed by offices.”

The FAU report used publicly available quarterly data from the Federal Financial Institutions Examination Council Central Data Repository to calculate each bank’s total CRE exposure. The formula: the sum of CRE nonfarm-nonresidential mortgages, multifamily mortgages, CRE construction loans and unused CRE commitments as a percentage of the bank’s total equity.

Five Florida banks are on the list of the 157 largest banks. Two of those banks, Miami-based City National Bank of Florida, at 438.7%, and Winter Haven-based SouthState Bank, at 320.5%, are above the 300% threshold. Calls and texts to several SouthState officials were also not returned.

Calls to City Natonal were not returned prior to the Business Observer's deadline for this story, but after the story was published, a bank spokesperson sent a statement disputing its spot on the FAU report.

“The FAU study is incorrect. City National Bank of Florida’s commercial real estate concentration is 296%, which is within regulatory guidance and below the risk threshold established by the Office of the Comptroller of the Currency," the June 12 statement reads. "CNB’s commercial real estate portfolio continues to outperform industry averages, with a loan-to-value ratio of 50%, a debt service coverage ratio of 1.8x, and non-accruals in Q1 of only 0.4% of the bank’s total loan portfolio. These metrics are the result of CNB’s disciplined credit process and sharp focus on relationship banking within Florida — the strongest commercial real estate market in the U.S.”

McCurry, speaking as a banker in general says several other factors go into bank failures — not just commercial real estate loan overexposure. “That doesn’t mean a bank is going to fail,” he says, “but it might mean they will need to raise more capital and be ready to absorb some losses.”

The last bank failure in Florida was Fort Walton Beach-based First City Bank of Florida, shuttered Oct. 16, 2020, according to a Federal Deposit Insurance Corp. database. Before that the last Florida bank failure was in 2015. That stretch pales in comparison to 2011-2013, when federal regulators shut down 25 Florida-based banks, many of which were crushed by capital shortages amid the housing-generated recession.

One strategy to avoid the overexposure to commercial real estate loans, McCurry says, is diversification. Seacoast takes that approach, according to both McCurry and Seacoast officials, in an emailed statement answering questions from the Business Observer. Seacoast has a commercial real estate exposure rate of 251.2%, the FAU report found — under the regulatory excessive threshold.

“Seacoast Bank intentionally maintains a very conservative risk posture,” Seacoast Bank President and CEO Chuck Shaffer says in a statement, adding “we maintain some of the highest capital levels in the banking industry, with a 14.6% Tier 1 capital ratio, ranking Seacoast Bank among the nation’s top 10% strongest banks.”

“Furthermore, our diversified lending strategy across various asset classes, industries and loan types ensures a broad exposure distribution, which has been instrumental in managing risk,” Shaffer says.

Shaffer adds the bank doesn’t lend to large office buildings in downtown business districts; maintains a commercial real estate exposure largely within Florida, “which continues to see much stronger performance than many other geographies” nationwide; and has CRE loans that “are granular, with an average loan size of $1.7 million.”

Louis Llovio and Elizabeth King contributed to this story. This story was updated to reflect comments from City National Bank of Florida.