- December 16, 2025

-

-

Loading

Loading

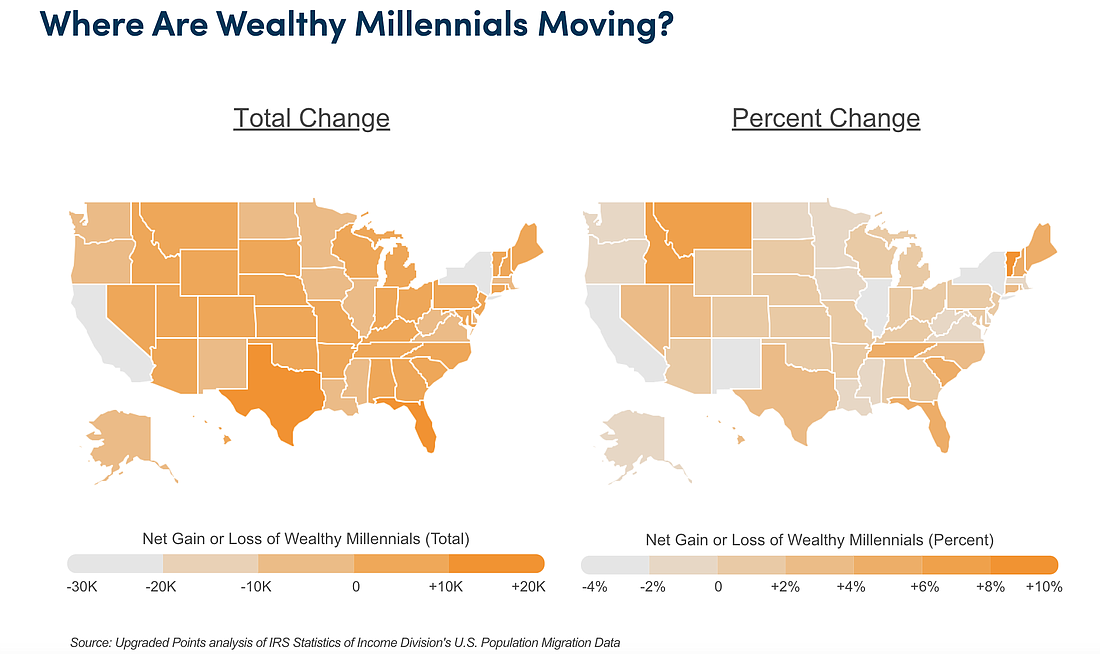

A new study shows Florida is a national leader in attracting wealthy millennials to relocate to state.

That influx, according to the report from travel content provider Upgraded Points, has led Florida to gain nearly $7 billion in its tax base, among other highlights.

The millennial generation — those currently aged 27-42 — has faced many challenges, including the 2008-09 recession, higher levels of student loan debt and unmoving wage growth. But the study says things are looking up for the generation. It currently makes up the largest segment of the labor force as well as make up the majority of homebuyers.

With COVID-19, the generation was given opportunities like being able to look for jobs with higher wages or better working conditions. Many older workers retired early as well, opening up opportunities for millennials to move into higher paying roles, the report states. It also paved the way for remote work.

In August and September 2022, the U.S. Bureau of Labor Statistics found that 27.5% of workers were teleworking either some or all of the time.

The added remote work allowed millennials to have more control over where they worked, which, the report says, might explain the jump in out-of-state migration from 14.2% in 2020 to 17.3% in 2022.

Citing individual tax return statistics provided by the IRS, the study found that almost 6% of that migration was of those under 25. Millennials contributed to about 13% of the out-of-state migration between 2020 and 2021.

Wealthy millennials in particular, those earning more than $200,000, moved more than the majority of middle-income workers. And it turns out, they moved to Florida.

According to the study, both Florida and Texas each added more than 15,000 millennials making over $200,000 in 2021. The state of Florida gained 5.6% of wealthy millennials for a $6.9 billion tax base change from wealthy millennial movers. While nearly 10,000 wealthy millennials said goodbye to the state, 26,860 drove past the Welcome to Florida sign to their new home state.