- April 21, 2025

-

-

Loading

Loading

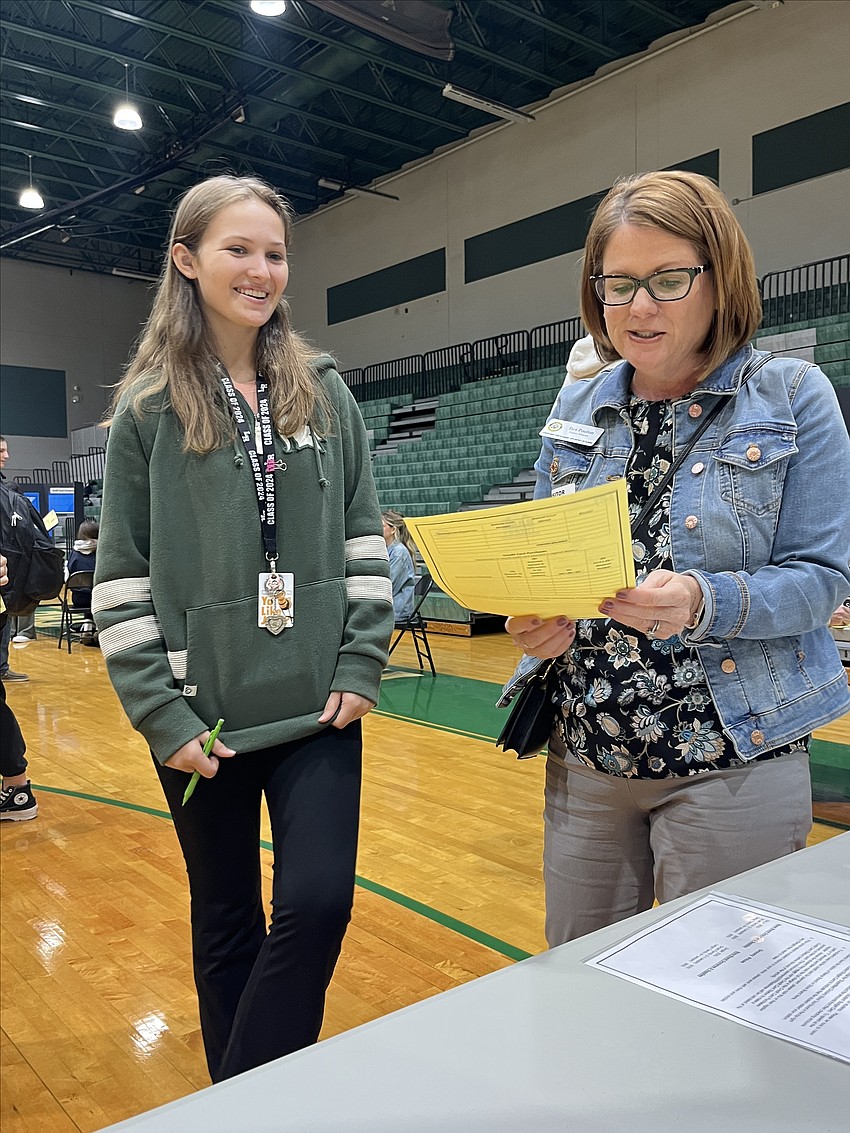

Rather than being a senior at Lakewood Ranch High School in east Manatee County, Cayman Corscadden stepped into the future on Nov. 6-7.

In this case, Corscadden lived the role of a personnel recruiter, and setting up her finances on the salary that goes along with it.

It was part of the Manatee Chamber of Commerce’s annual Big Bank Theory. Big Bank is a financial literacy program presented to all 12th grade students in Manatee County Schools. Volunteers from the business and civic community, according to the chamber, work in one of more than a dozen stations that require the students to consider the financial responsibilities of a 25-year-old adult with, like Corscadden, an assigned job and salary. Students make spending decisions such as whether to buy a new car, a used car, or a bus pass all while trying to stay within their budget.

Students also had to figure out how they would afford housing, insurance, childcare and other necessities and luxuries of life. In Corscadden's case, it had to be accomplished with a monthly income of $4,333 — the assigned monthly salary for her role. That's an annual salary of $51,996.

She had a spouse who earned $1,000 monthly along with a 3-year-old daughter to support. After taxes, she had $4,206.42 to spend monthly.

The chamber set up 14 stations for the seniors to work on their particular budget.

Corscadden’s first stop was at the “That’s life” station where, like in real life, the students experience financial ups and downs. She had to randomly select a card that would either give her financial troubles or add to her income.

Cards ranged from “your brother is moving in and he’s paying rent; add $100 per month to your account” to “happy birthday! You received $50 from your dad” to “your toilet is leaking; pay a plumber $75 for repairs” to “you need to get a prescription filled and your insurance doesn’t cover the full cost, pay $125.”

Corscadden received an unexpected bonus when she received $50 from a scratch-off lottery ticket.

In selecting priorities, Corscadden went to purchase groceries first. She had to decide whether the cost of name brand groceries was worth it or if she should opt for the generic brands. “The discount groceries are going to be just as good as the name brand,” she says.

To feed her family, $500 was deducted from her monthly income.

Corscadden’s next stop was to set up utilities. She had not yet determined her housing situation, so a volunteer walked her through her utilities options based on her potential housing.

With a two bedroom, one bathroom apartment, she had to spend $150 for gas, electric and water. Then came more decisions.

Did she want a cell phone? Yes. That’s $80 a month.

Did she want a cell phone for her spouse? Yes. Another $40.

What about internet and cable? The bundle cost her $60.

“It was weird that buying internet and cable was less than buying one,” she said. “It was a good deal.”

Corscadden’s balance was down to $3,426.42. She was getting nervous. She hadn't even paid rent yet.

In the real world, she has thought about becoming a zoologist. But during the exercise, she began to learn lessons about the cost of living.

“(Zoologists) don’t make the most amount of money,” she says. “I might have to rethink my life, but I think you have to love what you do. If you love your job and make enough to live, what you have is enough.”

Many more decisions were in the offing — from the apartment hunt to health insurance to childcare and more. The exercise, overall, forced her to analyze her priorities and question every expenditure — part of the objective of the program.

One regret? Corscadden wished she changed things around so she could have spent more money on childcare.

She also would have spent more money on her car.

"If it’s new, it’s in better condition," she says of the car. If you have a used car, it’s more likely to break down. That’s going to cost you more in the long run.”

Her biggest takeaway?

Prioritize, plan ahead and save as much as you can.

“My savings plans haven’t been as good as they should be," she says, "and now I really need to save after seeing how much things actually cost in the real world."

This article originally appeared on sister site YourObserver.com.