- December 13, 2025

-

-

Loading

Loading

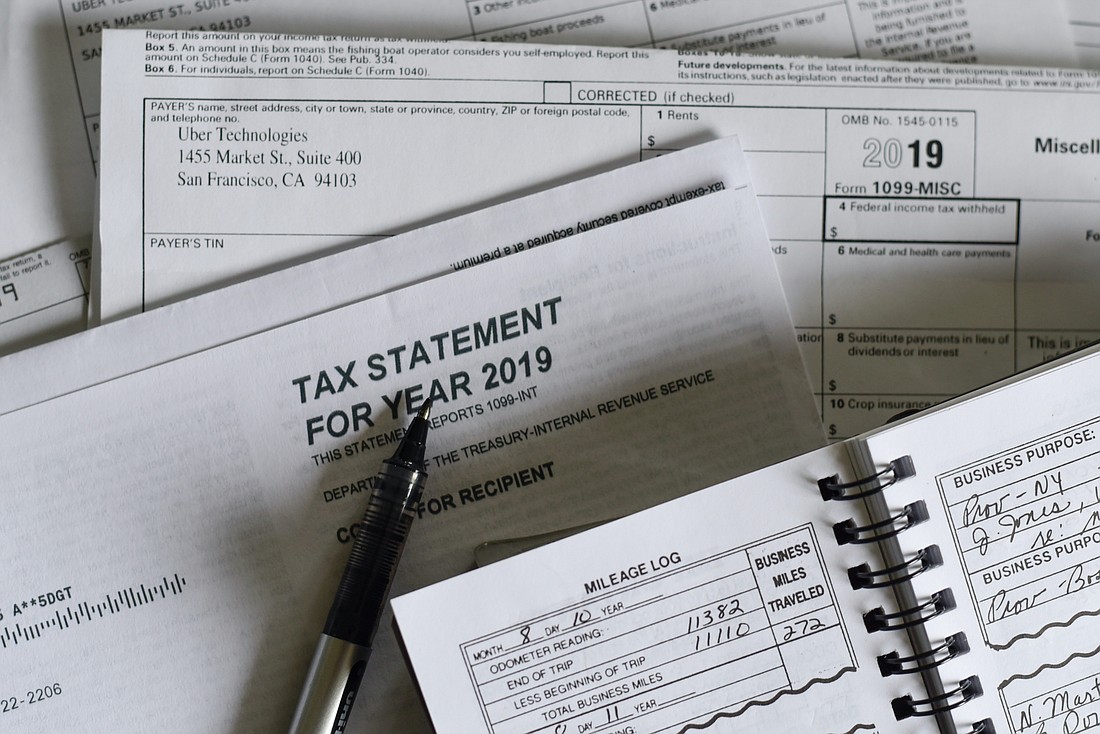

So, you inherited a Walgreens, sold it, made some money and are now looking to save on your taxes. What do you do?

Well, the federal government has a rule in place that can help.

It’s called a 1031 exchange and is named for a section of the IRS code that “allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange.”