- April 16, 2025

-

-

Loading

Loading

Manatee County is set to increase the amount of money it collects from developers working on certain projects at some point next year — part of an effort to begin offsetting the cost of rapid growth and to bring what it collects closer to a more realistic amount.

The money will come from an increased collection of impact fees, which are charged on projects that add to the demand for infrastructure. The county, and other localities across the state, charge these fees to meet a demand for roads, law enforcement and park needs that come with population growth.

But this being Manatee, impact fees, a rather benign government function, has turned into something of a political battle. And in a county where Republican politics dominate and county commissioners have found themselves embroiled in controversies from alleged DUIs to setting up favored COVID-19 vaccination stations, even the usually simple process of collecting impact fees has become a point of contention.

On one hand, commissioners argue that simply raising the amount collected will be enough to compensate for the cost of growth the county has seen in the past several years. But one vocal commissioner, George Kruse, accuses his colleagues of playing politics as an election year approaches and giving developers a sweetheart deal.

“The answer is, the people who pay the impact fees don't want to pay. When given the option to pay money or not to pay money, almost everybody on the planet is going to opt to not pay money,” Kruse says.

“And if those people are reinvesting their savings from not paying impact fees in campaigns, then you may consider not charging them the fee if that's where those savings are going to go.”

The issue came to a head Nov. 14 when Manatee County commissioners voted to begin the process of increasing the amount collected in impact fees for projects by 10%. Commissioners asked the development services and legal departments to draw up wording that meets state requirements in order for the increase to begin sometime next year.

The commision can then vote to approve the changes, which would likely be implemented in June. A date for when the plan will be presented to commissioners has not been set yet.

But, Kruse says, the wording commissioners used when coming to this decision is crucial to understanding their motives. The commission did not look to actually raise the impact fees, he says. What they did is ask that the county begin collecting 100% of impact fees rather than 90% as it has for the past nine years.

While yes, charging 10% more will be an increase on the amount collected, the change is really a distinction without a difference.

You see, Kruse says, the 100% that will now be collected is based on fees recommend in a 2015 impact fee study that was based on 2014 data.

Kruse, at an At-Large commissioner elected in 2020, argues that what his colleagues are doing is paying lip service to citizens — and voters in next year’s election — by saying they are increasing impact fees when in fact they are only collecting the full amount of what was recommended eight years ago.

He writes on his Substack blog page that “the calculated costs of growth would be substantially outdated at this point even in normal times. But the high-inflationary period we’ve gone through these past few years has further exacerbated this problem and this massive shortfall.”

(Kruse, it should be noted, voted with his colleagues for increasing the amount collected to 100%.)

Kruse in making his argument online, in meetings and in an interview with the Business Observer cites a 2023 study ordered up by the county that states only about 40 cents for every dollar of the actual cost of growth is being collected. If the county were to adopt the recommendations in the study, it would collect $115 million more in impact fees, he says.

The study was conducted by the consulting firm Benesch. It recommends new fees more in line with current standards. But commissioners and county staff say there are concerns with the methodology. They want a new study.

Impact fees are hardly ever a political hot potato in communities across the state and the country.

Yes, there are often discussions of how much should be paid to offset the cost of growth. But those conversations are usually about policy and bureaucracy, with developers or builders wanting to pay as little as possible and community members or politicians wanting them to foot a bigger chunk of the bill.

And there are a wide range of opinions, as is to be expected. Mike Rahn, recently appointed chair of Manatee’s commission, for one opposes them altogether. “I have not hidden the fact that I'm not a fan of impact fees,” says Rahn, a banker specializing in residential mortgages and past president of the Home Builders Association of Sarasota-Manatee. “I think it's a regressive tax.”

Yet, on Nov. 14, he is the one who made the motion to increase the collection to 100%.

In other words, they are fairly routine.

But as what happens often in Manatee, the fairly routine turns in accusation and histrionics. The fairly routine, turns into personal attacks.

When Kruse was arguing his point — and taking shots at his colleagues in the process — Nov. 14, then-board chairman Kevin Van Ostenbridge accused him of being ill prepared and not being informed on the subjects that came up for discussion, including impact fees.

“You sit up here and you're bloviate on this dais, putting out this persona of yourself that is not accurate. That is not true at all,” Van Ostenbridge said. “You go and you do town halls and you bloviate there. But outside of bloviating, you really don't do anything.”

Sitting in front of Van Ostenbridge as he made that comment was a small sign that read: Professionalism and Civility. Anything less will not be tolerated.

In all fairness, the sign and its message was pointed away from him.

What’s lost in the personal attacks and in the accusations of wrongdoings coming from Manatee elected officials is the importance of impact fees and the role they play. And why, most agree, they need to be increased.

As defined in the county’s Fiscal Year 2024 budget, “Impact fees are designed to help guarantee that new development pays its share of the costs incurred by Manatee County to meet those needs.”

By law, the fees are set aside for paying for capital costs that come along with growth — more roads, law enforcement, parks and libraries.

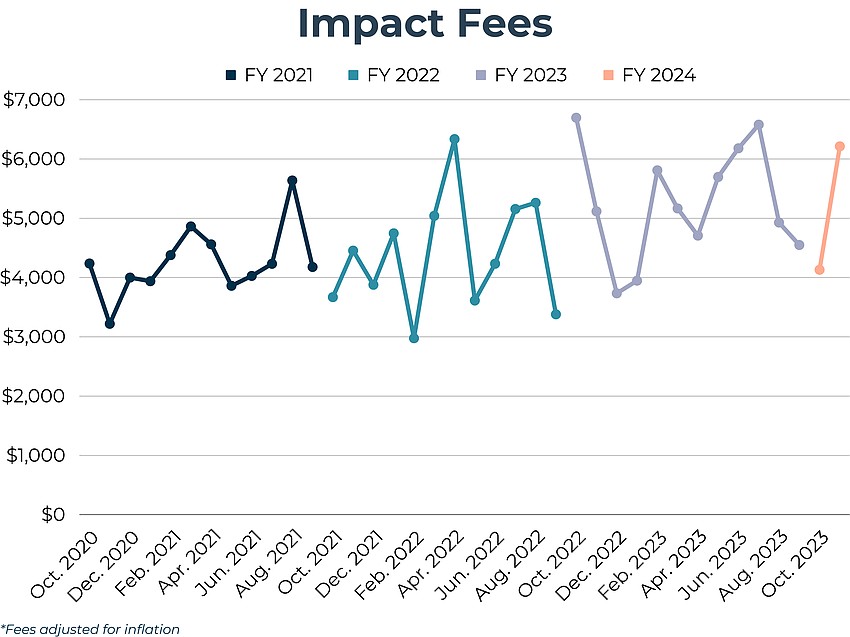

According to a progress report posted on the county administration's webpage, in fiscal 2023 Manatee collected $62.2 million in impact fees. Thus far in Fiscal Year 2023-2024 (October and November), the county has collected $10.3 million.

The county projects impact fee collections for fiscal 2024 to total $44.9 million at the current 90% collection. That would jump to $49.39 million each year if the full 100% is collected.

The fees are governed by the land development code and every building fits a certain category, says Nicole Knapp, director of Manatee’s Development Services Department. In her role, politics is not a factor. She advises the board and then carries out its instructions.

But it’s not that simple and it’s not a flat fee.

Knapp says the fee schedule is broken out by the type of dwelling unit — residential, multifamily, mobile home, duplex — or whether it’s retail, office, medical, commercial industrial — light or heavy — that is going to be built.

The fee itself is determined by the type of impact a particular business’ land use has on the county’s infrastructure. For instance, a new light office warehouse doesn’t create any demands on libraries or parks. So, the project would only be assessed for transportation, law enforcement and public safety.

A new home, though, is assessed for each one — parks, libraries, transportation, law enforcement and public safety — because in theory the residents will need and partake of all of the amenities.

Impact fees “are a significant source of revenue right now to help fund our capital improvements. Without them, you have to find another funding source,” Knapp says.

“But if you were to look at the projected revenues, and revenues that we currently bring in, it's a significant impact. But it's a policy decision of the board. We can tell you what they should be based on a study. But it’s a policy decision of the board and no community has to assess them. They can find another funding source. But it is a huge impact.”

Which gets us back to politics and the way Manatee’s leaders approach matters.

The argument Kruse makes is one that is understandable and would probably resonate with voters — and possibly his colleagues — if they were not coupled with accusations of dirty dealing and kowtowing to developers.

Lost in the accusations, is the argument that by not increasing impact fees to be more in line with current economic realities the county commissioners risk putting the burden on current residents rather than on newcomers and builders.

Residents, Kruse says, are always going to demand roads be built or improved, that there are libraries to go to and there are enough police. As the county’s population grows and there is more development, those needs get more acute.

So Kruse's argument isn't about the 'if' of higher impact fees. It's about who will pay for it.

If the county doesn’t collect enough in impact fees, the money, to Knapp's point, has to come from somewhere else, whether it is borrowed in the form of bonds or taken from other parts of the budgets. If that happens, the developers and builders profit.

And that’s not fair, he says.

(Several builders contacted for this story did not respond to a request for comment nor did the Manatee-Sarasota Building Industry Association.)

“Our concern is, first and foremost, to provide the highest quality of life for the lowest cost of living. That should be my goal,” Kruse says.

“And I can't provide (residents) with the high quality of life — via parks, and less traffic and congestion — if I can't build that for them. And if I can't find the sources of capital from where I'm supposed to find it, I have to find it from them, which then negates the low cost of living side of it, because I have to eventually increase their taxes to come up with general funds to pay the debt service on the bond side to float to provide them that higher quality of life.”

But Kruse being Kruse, and Manatee being Manatee, a well thought out, logical argument is rarely enough. There has to be a shot taken or an insult hurled. And that tendency, it can be argued, also costs residents.

“Just remember,” he wrote in closing out his case for higher fees on Substack, “everyone on this board has an opportunity right now to act on these statements and actually prove their sincerity. But, I guess $115 million is a small price to pay for some great sound bites in 2024.”