- April 4, 2025

-

-

Loading

Loading

Courtesy image

Courtesy image

Rent increases, when paired with high interest rates and declining revenue, not surprisingly, makes for a toxic concoction in terms of small businesses paying rent on time.

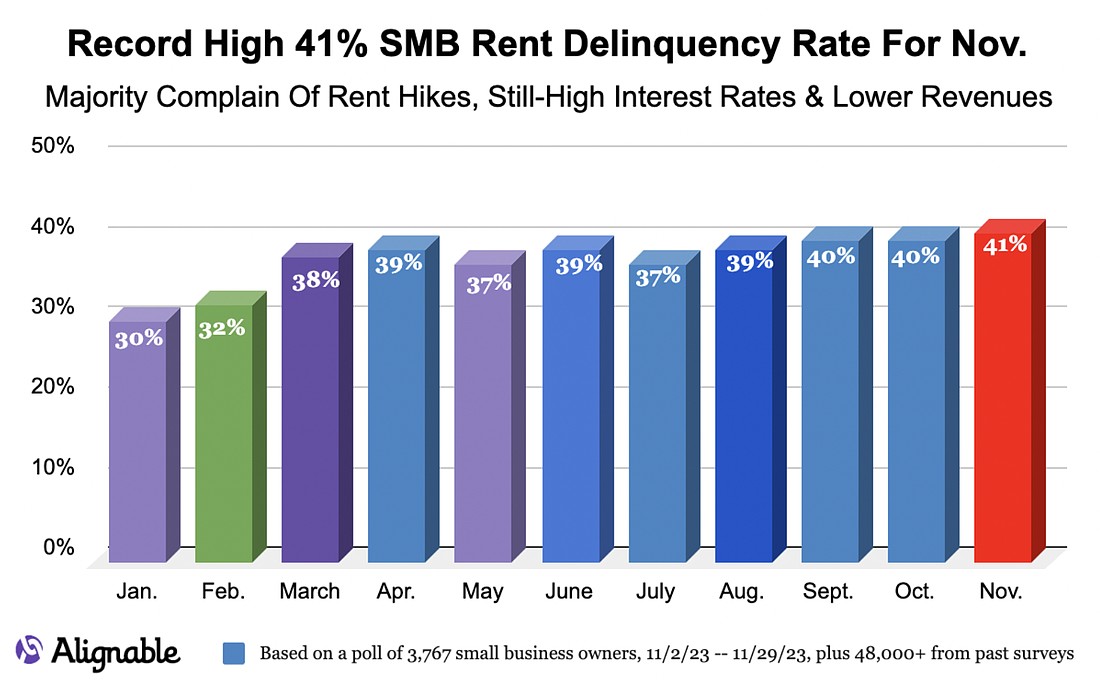

That’s the key takeaway from Alignable’s November Rent Report. The headline: More than four of every 10 small businesses nationwide, 41%, couldn’t pay rent on time and full in November, the report from the small business online networking website found. That’s the highest monthly rate of 2023. It’s 1 percentage point over 40% in each of September and October, and 11 points higher than the low point of the year, 30% in January.

The good news, at least for the Sunshine State, is Florida had a 27% delinquency rate in November. That’s down 18 percentage points from 45% in October, the report found.

But the data remains concerning, especially the trifecta of rent, revenue and rates.

On rent, the report found 55% of small business owners say rent is higher than it was six months ago, up 5 percentage points from last month. Meanwhile, 58% of respondents say they expect their business to make less income in the 2023 fourth quarter over the same period last year.

The final whammy? Nearly half the respondents, 49%, say they don’t expect to recover economically until the Federal Reserve lowers rates by at least three points. That’s up 11 percentage points from October, when it was 38%. That cohort, according to the report, says the “current rates are cutting into their margins, reducing consumer spending and making it harder to pay off SBA loans.”

The Alignable findings are based on responses from 3,767 randomly selected small business owners surveyed in November, along with input from over 48,000 other poll participants over the past year.