- December 15, 2025

-

-

Loading

Loading

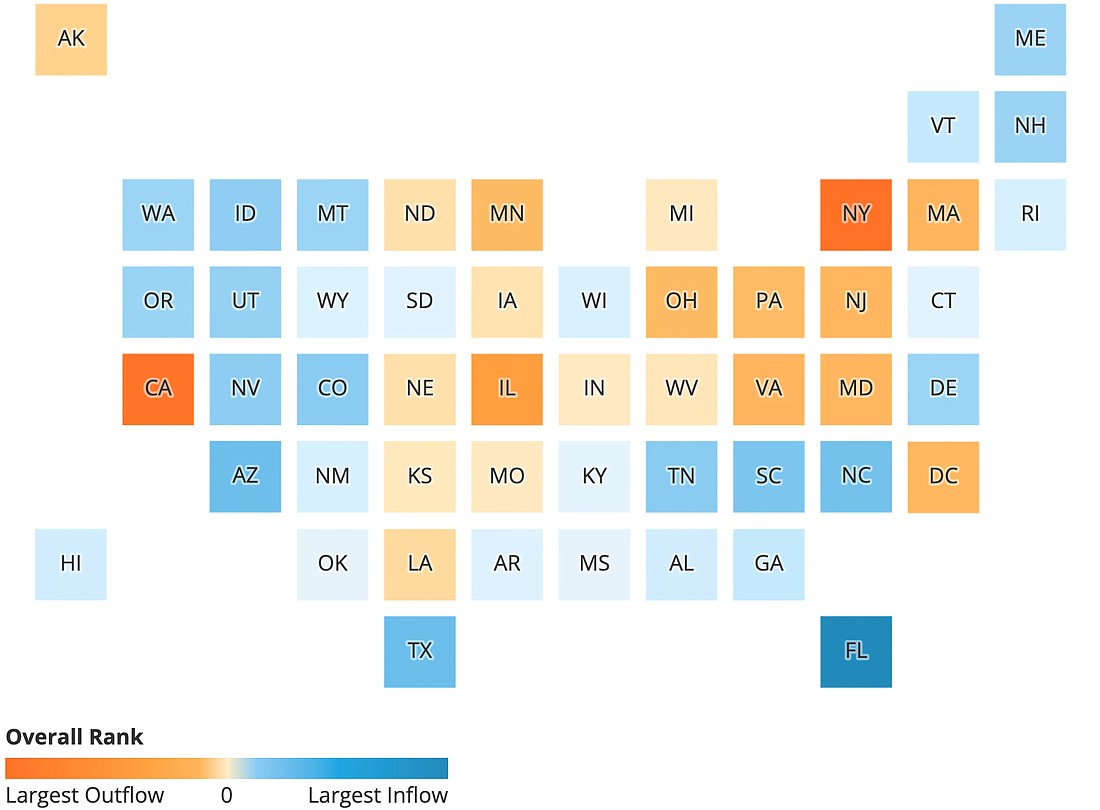

From the sunshine and beaches to the absence of state income tax, Florida is no secret to financially well-off people in the other 49 states. A recent study proves just that.

The study, recently released by data firm SmartAsset, identifies where the majority of high-earning residents are moving to and out of within the country. Florida saw the most migration.

The study covered households that make over $200,000 a year, given their contribution can have a significant impact on the state they leave. SmartAsset looked at the flow of tax filers for each state between 2019 and 2020.