- December 25, 2024

-

-

Loading

Loading

As mortgage rates continue to rise, the number of homebuyers backing out of contracts jumped to record highs in June, with Lakeland, Tampa and Cape Coral among the localities with the highest number of sales falling through, far outpacing the national average.

The data, according to a report published July 11 from Redfin, points to a slowdown in the housing market as interest rates increase making homes that were affordable just a month or so ago no longer fit in buyers’ budgets, leaving some with little choice but to walk away.

“If rates were at 5% when you made an offer, but reached 5.8% by the time the deal was set to close, you may no longer be able to afford that home or you may no longer qualify for a loan,” Redfin’s deputy chief economist Taylor Marr says in the report.

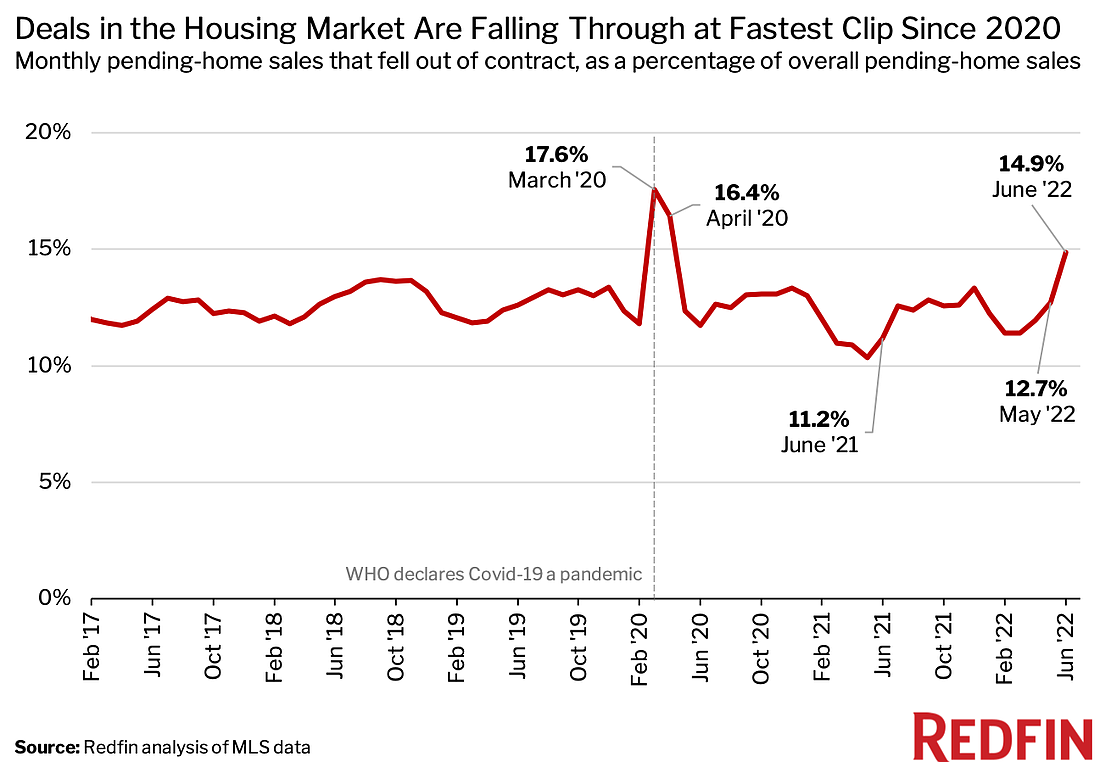

According to the report, 14.9% of contracted home sales, about 60,000, fell through across the country in June. That, Redfin says, is the highest percentage on record. In comparison, 12.7% of sales fell through in May and 11.2% fell through June 2021. (March and April 2020 also saw a large number of deals fall through as well, but that was an exception caused by the near collapse of the housing market at the beginning of the pandemic.)

Redfin used MLS data going back through 2017 to produce the report.

Lakeland and Cape Coral, with 26.7% and 25.7%, respectively, had the second and third highest percentage of buyers reneging on deals in the country in June, behind Las Vegas, the report found. Tampa was No. 12, with 23%.

Overall, Florida, which has had one of the hottest real estate markets in the country, led the nation with the most deals falling through, with eight cities cracking the top 15.

One reason could be that Florida, despite rising housing prices affecting locals, remained less expensive than markets in states where record numbers of new resident were flocking from.

While the higher interest rates do not affect cash buyers too much, they make a big difference to the average buyer who relies on financing to buy a home.

Lindsay Garcia, a Miami real estate agent quoted in the report, says some buyers “had to bow out because they could no longer get a loan due to the jump in rates. Buyers are also more skittish than usual due to economic uncertainty.”

A slowdown in the housing market could also have a negative impact on a segment of Florida’s population already struggling to keep up, renters.

If the exodus to Florida from other states continues as it has since 2020 but fewer people buy houses, rents are likely to continue to rise, pricing many renters out of their homes.