- January 2, 2025

-

-

Loading

Loading

Of all the bills filed this spring in the Legislature, Senate Bill 76 is far and away the session’s most important legislation.

Not election integrity. Not COVID-19 liability. Not education. Not even the budget.

It’s SB 76.

Filed by Bradenton Sen. Jim Boyd, SB 76 deals with the mundane subject of property insurance.

Here’s the nub of it:

If Boyd’s bill passes, it will save Florida’s housing market from collapse — and save Florida’s economy.

If it fails, Florida’s housing bubble will pop. The real estate sales markets for residential and commercial properties will come to a halt. And the ripple will spread harsh economic effects throughout all of Florida:

• Property insurance rates — already rising between 20% and 50% in the past year — will double within three years.

• Florida-based private property insurers will go bankrupt.

• The national carriers will continue to avoid Florida.

• Taxpayer-owned Citizens Property Insurance Co. will be the only source of property insurance, making every Florida taxpayer liable to cover billions of dollars of losses in the event of a major hurricane.

• There will be no such thing as affordable housing because insurance rates drive up the cost of housing.

• Millions of Florida’s senior citizens will be unable to afford to stay in their homes.

“100% correct,” said Boyd, who has spent his professional life owning an insurance agency in Bradenton. “There’ll be tsunami effects on real estate, banking, mortgage lenders.”

The tsunami has already started, according to Guy Fraker, a corporate strategist who spent six months in 2020 researching the condition of Florida’s property and casualty insurance market. “Florida’s P&C market is in a free-fall collapse,” Fraker told us. “This market is going to fail.”

“It’s going to be a nightmare,” said Gregory Holder, a recently retired circuit judge in Hillsborough County, who presided over thousands of insurance cases in his 26 years on the bench. “The sky is falling. It is a financial crisis for the citizens of this great state. Everyone is affected by this.”

Barry Gilway, the CEO of state-owned Citizens Property Insurance Co., is not as dire. “Something has to give,” he said. He agrees current conditions are unsustainable. “Absolutely,” he said.

Collapse? Free fall? Unsustainable? Nightmare?

Hyperbole?

If you’re a property owner, you’re seeing it. Your property insurance rates for 2021 have risen anywhere from 20% to 50% over 2020. “My rate on my house went up 40%,” Boyd said.

Michael Mailliard, the owner of Longboat Key-based MIC Insurance, told us 25% of his clients have been unable to renew their existing policies and have hit sticker shock when Mailliard informs them of their higher-priced options.

For thousands upon thousands of Florida homeowners, however, the only option is to be insured by Citizens, the state’s insurer of last resort. Citizens has been taking on 4,000 new policies a week since June 2020. Gilway doesn’t see that stopping. After shrinking its policyholders down to 420,000 in 2018, it now expects that number to reach 700,000 by the end of 2021.

Here’s risk to that: As the state-owned insurer, Citizens has the legal authority to assess all Florida citizens if it runs out of money. The more policyholders Citizens has, the higher the risk for all Floridians.

All of this is not because of the risk of hurricanes. It’s because of insurance-claim lawsuits.

In particular, to be precise, this insurance crisis is a result of the tsunami of lawsuits against insurers (primarily roof related) that has washed over the entire state in the wake of Hurricane Irma, the 2017 Category 5 storm that washed out much of the Keys.

Take in these statistics:

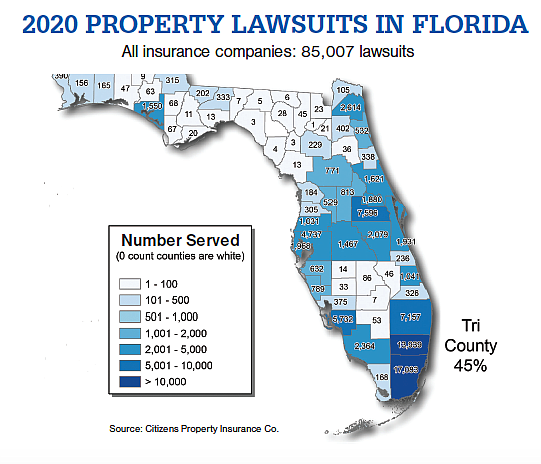

n Total damage-claim insurance lawsuits filed in Florida:

2013: 27,416 2014: 31,647

2015: 37,820 2016: 41,851

2017: 49,148 2018: 82,663

2019: 84,087 2020: 85,007

n Amounts paid out by insurance companies in Florida since 2013 to cover damages and legal fees related to these lawsuits: $15 billion.

Now here’s the kicker:

• Of that $15 billion insurers paid out,

71% covered attorneys’ fees;

21% covered insurers’ defense fees;

Only 8% went to property owners.

Put another way: Trial lawyers took in $10.65 billion, while Florida citizens whose properties were damaged were paid only $1.2 billion. Or, to bring that differential into a more digestible comparison, Fraker’s report shows a lawsuit in which Security First Insurance Co. was ordered to pay a damage award of $142 to a homeowner and $31,140 in legal fees to the consumer’s lawyer — 21,041% more than the awarded damages.

Disparities like the one above are common. Fraker’s report shows another suit in which the insured received $41,000 in damages while the attorney representing him received $1.2 million. Another one: $35,000 to the homeowner, $712,677 to the attorneys. The list of these goes on and on.

Boyd told a Senate Committee of one attorney who filed 1,234 lawsuits against insurers in three months. “That’s 13.4 a day,” he said.

Holder told the Senate Judiciary Committee earlier this month that the 13th Judicial Circuit “has several thousand of these cases with well over 500 cases filed by one law firm.”

Holder experienced frequently cases he described as follows: “On June 6, an attorney would file suit on a claim for a leak in the kitchen. On June 20, he’d file for a leak in the bedroom. And on July 4, he’d file one for a leak in the bathroom. All from the same policy. Later on, another law firm would file three lawsuits for the assignment of benefits to the contractors, all for the same leaks.”

Altogether, this one home and policy would account for six lawsuits.

“Upon discovering this clearly unethical and arguably illegal conduct,” Holder wrote in a letter to Sen. Jeff Brandes, the chair of the Senate Judiciary Committee, “I conducted my own research compiling a list of more than 1,000 cases filed by just four attorneys in two separate firms,”

This onslaught of lawsuits has brought on the financial crisis that is about to blow up Florida’s property and casualty insurance industry and the companies that underwrite the insurance behind Florida’s 6.5 million properties.

After three profitable years from 2013 through 2015, Florida-based insurance companies have reported five consecutive years of underwriting and operating losses.

Last year, underwriting losses for all property insurers in Florida — what they paid out in claims after premiums — increased 138% to $1.58 billion compared to $664 million in 2019. Net losses — premium and investment income minus all expenses — mushroomed from $362 million to $747 million, up 106%.

These losses have occurred even in the face of the state Office of Insurance Regulation approving rate increases of 10%, 14%, 20%, 25% and 52% over the past five years.

Fraker said he had his “a-ha moment” about the Florida’s insurance market after interviewing two C-suite executives of global reinsurance companies. One referred to Florida as “the highest risk zone in the world.” Another told him:

“Hurricanes are not the biggest systemic threat. The lawsuits represent such a high degree of uncertainty, we don’t know how to model Florida.”

Gilway of Citizens, who has spent nearly 50 years in the industry, including CEO Zurich of Canada and executive vice president of Zurich of North America, says there is no other insurance market in the U.S. close to Florida, and that is for two reasons: “The overall judiciary environment and the strength of the trial bar.”

Says Fraker: “People think this is the insurance companies versus the lawyers. It’s actually the lawyers versus the consumers.”

In his report to the state Senate, Fraker wrote: “Think of the litigation costs to insurers as ultimately a tax upon Florida’s property owners they don’t know exists.”

In 2019 alone, Fraker wrote, the costs allocated to insurance lawsuits totaled between $2 billion and $2.5 billion. He figured that every Florida family in 2020 paid a $651 annual hidden tax that no other state has — money that went “into a fund owned by fewer than 2,000 stakeholders [lawyers].”

How did this happen?

Gilway pegged it. The Florida trial bar has manhandled the Legislature for decades, crafting and shepherding legislation into law that tilts the legal system and incentives in its favor.

There are formulae for attorney fees and contingencies that allow multipliers to be applied to attorney fees, predictably resulting in higher legal fees and ultimately higher insurance premiums to consumers.

In addition, another driver of the current crisis are the thousands of lawsuits related to roof replacements. Contractors go door to door through neighborhoods urging homeowners to let them inspect their roofs, hoping to parlay the tiniest leak into a total roof replacement at the expense of the insurer. Many of these contractors leave leaflets on homeowners’ doors offering $500 bonuses for referring friends.

To address the crisis, Brandes convinced Senate President Wilton Simpson at the end of the 2019 legislative session of the urgency for reforms — even if it means taking on the trial bar. Brandes, Boyd and Senate Insurance Committee staffers collaborated to craft SB 76 (see box).

Predictably, the trial bar, including senators and House members who are trial lawyers, are fighting to stop key provisions, especially one that would align attorney fees with damages and another that would reduce to two years from three the time homeowners can file a claim.

Fraker, who is neither an insurer nor an attorney, said Boyd’s bill would be a major fix to the litigation issue and bring stability to the market. Gilway said it would be a good start. The two of them, along with Boyd and Brandes, say if it doesn’t pass, there will be nothing to stop the runaway litigation.

“Something has to give,” Gilway said.

Their fear: the trial bar’s grip on the House.

Senate Bill 76 was expected to have its last committee hearing March 25 before going to the Senate floor. In contrast, a similar but less comprehensive insurance bill in the House, House Bill 305, only won its first of three committee approvals March 23.

A telltale sign of a bill’s ultimate fate is the speed at which it moves through committees. If either of the next two House committees balks at hearing HB 305, we’ll know who stopped it.