- April 11, 2025

-

-

Loading

Loading

Cryptocurrency. It is all over news feeds, in newspapers and chat shows. It’s everywhere.

Elon Musk speaks, and prices skyrocket. He speaks again a little later, and they crash.

Carol Baskins, of Tiger King fame and the owner of Big Cat Rescue in Tampa, even got into the game creating what she calls “purr-ency.”

But pop culture aside, cryptocurrency is a serious topic and a growing legion of business owners, bankers and economists consider it the future of money. They see cryptocurrency as an alternative to how money has traditionally worked and the logical extension to what in, in recent years, is increasingly becoming a digital economy.

“When I say the world is heading toward crypto, I honestly believe that,” says Marlissa Gardner, founder of Emillions Art in Naples.

“Within the next five to 10 years, worldwide, we’re probably going to get rid of paper money. Do I know that? No. I don’t. But I feel it and I feel the shift in people’s interest.”

What is it?

Even as cryptocurrency becomes more popular and more people begin to adopt it, it’s still a mystery to many — even for some who are its most passionate adherents.

Cryptocurrency is a network of encrypted digital currency that can be used, like traditional money, to buy and sell goods. Unlike a dollar bill, it's subject to wild price fluctuations, especially on sites like Reddit.

Proponents say the technology behind crypto, blockchain, will change the way business is done across all sectors by removing the reliance on third parties — banks and brokers. What blockchain technology does is establish a record of transactions using a network of computers and using digital tokens to transfer value.

To date there are over 4,000 crypto currencies. Among the best known and most used are Bitcoin and Ethereum.

So cryptocurrency — while it is created, administered and underwritten by online networks — is much like any other currency. The big difference? It's not an official currency like the dollar because it's not backed by federal governments.

The easiest way to think of its real world usage is to imagine it as a foreign currency.

When you have a dollar and travel overseas, your dollar can buy the currency of the country you are visiting. How much you are able to buy — exchange —your dollar for, is the value of the dollar on the market at the time.

Basically, you buy a Yen for a dollar and how much Yen you get depends on how much the dollar is worth.

Cryptocurrency pretty much works the same way.

Let’s say that it costs you $500 to buy a token from Bitcoin. You then find a Rolex that a seller has priced at $10,000. With 20 tokens, you buy the watch.

Straightforward, right?

Well that’s where risk enters the equation.

The seller now holding the 20 tokens has a couple of options of how to use them. He can take the tokens to an online market and, just like if it was a share of a company’s stock, sell them for the current market value.

Or that person can just hold onto them in a digital wallet and, if it all goes well, watch the value go up over time.

Like Gardner, the Naples art dealer, Nick Friedman, co-founder and president of Tampa-based College Hunks Hauling Junk and Moving, is a crypto fan. College Hunks began accepting cryptocurrency for the payment for up-front franchise fees in May.

“Really, to me, that’s no different than if somebody wants to pay with Canadian dollars or if somebody wants to pay with pesos,” he says. “Because at the end of the day, somebody can wire us Bitcoin and we can convert it to U.S. dollars that same day.”

Why do you need it?

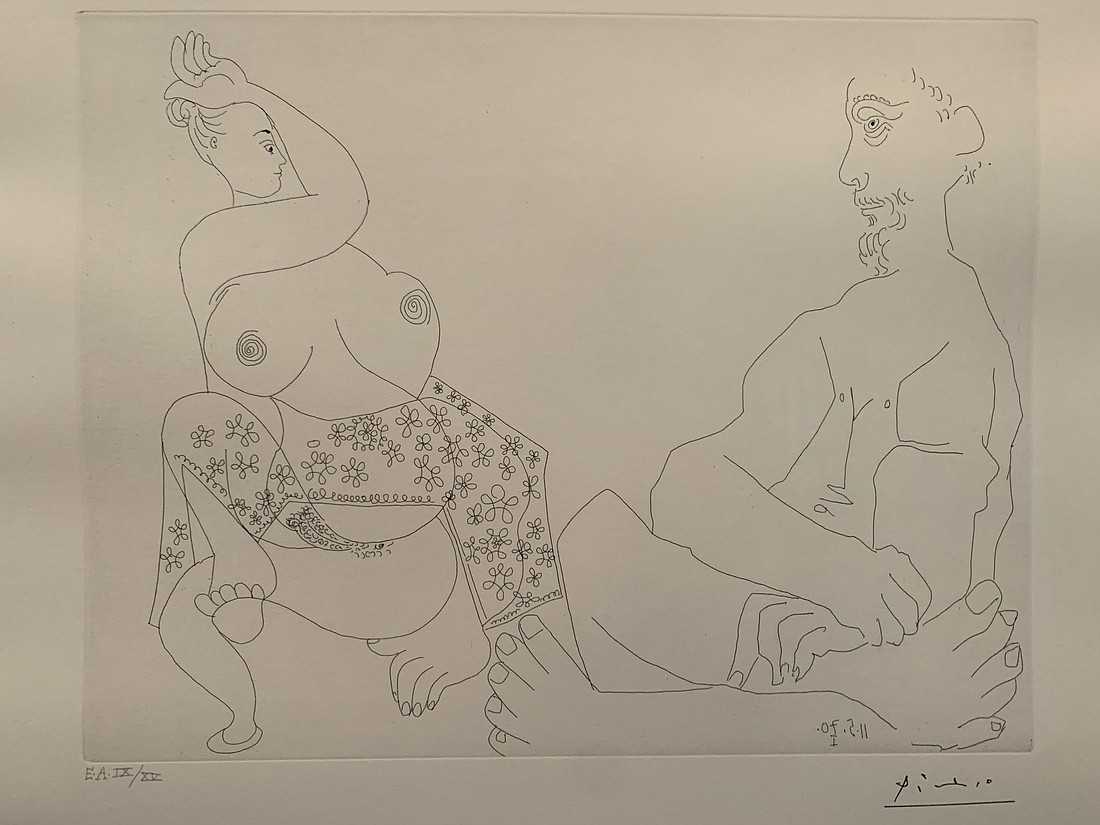

Gardner, meanwhile, sold a sketch by legendary Spanish artist Pablo Picasso last year for undisclosed number of IDON tokens, which is the cryptocurrency for Idoneus, a Swiss digital currency company for luxury assets. She regularly appears on television and writes about cryptocurrency and later this month is hosting a webinar for artists on how they can use Idoneus to sell their work.

One of the best features of using cryptocurrency for Gardner, whose works sometimes sells overseas for tens of thousands of dollars, is cost savings. Using cryptocurrency, she says, means avoiding transfer, wire and exchanges fees that come from moving monies among banks and across borders.

“That doesn’t happen with Bitcoin, or any cryptocurrency, because it’s the same,” she says, “So you can transfer from one wallet to another wallet.”

She says the process is seamless. “We don’t have to go through a bank, whatever bank you use.”

Another feature that cryptocurrency brings is protection, experts say.

That’s because of blockchains. Every transaction is noted and the blockchain for the particular network serves as both a permanent record of a purchase or sale as well as indisputable proof if there ever is a challenge.

This allows both buyers and sellers to have the faith in the process that the average person has when they spend a traditional dollar.

The future of money?

While cryptocurrency remains mysterious and the industry often resembles the Wild West instead of Wall Street, over time more and more people will adapt to bitcoin experts believe and, in time, it will become more accepted.

That's already begun.

Since the advent of Bitcoin in 2008, the adoption of cryptocurrency is increasing around the world. Statist, a global market research company, reports that the global user base of cryptocurrencies increased by nearly 190% between 2018 and 2020.

'Really, to me, (cryptocurrency) is no different than if somebody wants to pay with Canadian dollars or if somebody wants to pay with pesos.' Nick Friedman, College Hunks Hauling Junk and Moving

The U.S. Federal Reserve is already looking into the creation of the digital dollar and, last week, the government of El Salvador classified Bitcoin as legal tender.

One reason Gardner, and many cryptocurrency proponents, believe in the future of cryptocurrency is that most people are, in a way, already dealing with digital currency but don’t actually realize it.

Take a person’s paycheck for example.

In most cases, people have their paychecks deposited directly into their bank accounts. They then pay their cable bill online and buy gas, pay for groceries and rent a movie from Amazon using their debit card.

That person can spend their entire paycheck without actually touching a physical dollar, which means every penny they earned and spent was digital.

“Cryptocurrency, digital currency, is here to stay, and the underlying blockchain technology that run those applications, is going to transform lives and businesses for the good,” says Neil Pennington, senior advisor for strategy and innovation at Idoneus.

He throws in some caution, too.

“But like anything, somebody’s individual choice about whatever cryptocurrency they chose to use, they should be doing their own research and making their own decisions.”