- April 5, 2025

-

-

Loading

Loading

As 2020 wound down, a new report highlighted what could remain a glaring issue in 2021: the difficulties small businesses nationwide face in paying rent, stemming from the pandemic and COVID-19 related shutdowns.

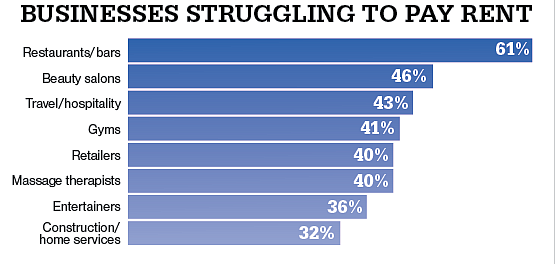

One of the more startling findings in the report, from small businesses data analytics firm Alignable, is with restaurants, where 61% of survey respondents report not being able to pay rent in December. That’s up from 42% in November. Beauty salons, at 46%, and travel/hospitality businesses, at 43%, round out the top three most-affected businesses.

Overall, 35% of small businesses owners nationwide reported they couldn’t pay rent in December, up 3% from November, the report shows. Minority-owned businesses have the highest rate of difficulty, at 49%, followed by women-owned businesses, at 38%. The report’s findings are based on the most recent Alignable rent poll, conducted among 9,204 small business owners in late November.

The poll also found that in some ways, rent hardships are geographical, based on the level of lockdown in a particular state. States with the highest levels of business owners struggling to pay rent, for example, include No. 1 New York at 43%, and Oregon and Illinois, both at 42%. Those are all states that have taken significant measures to curb activity in restaurants and hair salons, among other sectors, which increases rent payment anxieties. Florida and Texas, on the other hand, known for a more open environment for most categories of business, have a 35% and 34% rate, respectively. Missouri has one of the lowest rates in the country, at 20%.