-

-

Loading

Loading

The effects of the coronavirus outbreak on the tri-county area commercial market remain unclear. Prior to the coronavirus outbreak, the tri-county area had strong economic momentum, and the current report largely reflects the environment before the pandemic. It is too early to provide a quantitative assessment or forecast of the ultimate market impact of COVID-19. As with previous reports, our analysis focuses on the market activity reflected in current quarterly statistics. The overnight halt to the tourism industry will likely have repercussions for the local economy. In a year of evident political and economic uncertainty, we expect to see additional tempering in metrics – including asking rent growth and construction starts – as companies look for additional signals of where their businesses are headed this year.

MSC Commercial is committed to the goals of our clients and those of the commercial real estate industry. We will continue to monitor market movements as this situation evolves. Though the way we operate has changed, our team continues to work as an essential business remotely, supporting all our clients. Please feel free to contact us at any time. For questions concerning your specific sector or business, please reach out to one of our highly skilled advisors.

Office

8.3% Overall vacancy rate ↓

-3,984 SF YTD Net absorption ↑

$22.26 PSF Average asking rent (gross) ↑

*Arrows indicate change from Q1 19.

Rental Rate Table:

Rental Rate Chart:

Industrial

3.9% Overall vacancy rate ↑

-206,772 SF YTD Net absorption ↓

$7.97 PSF Average asking rent (NNN) ↑

*Arrows indicate change from Q1 19.

Overview:

Rental Rate Table:

Rental Rate Chart:

Retail

6.7% Overall vacancy rate ↑

-387,250 SF YTD Net absorption ↓

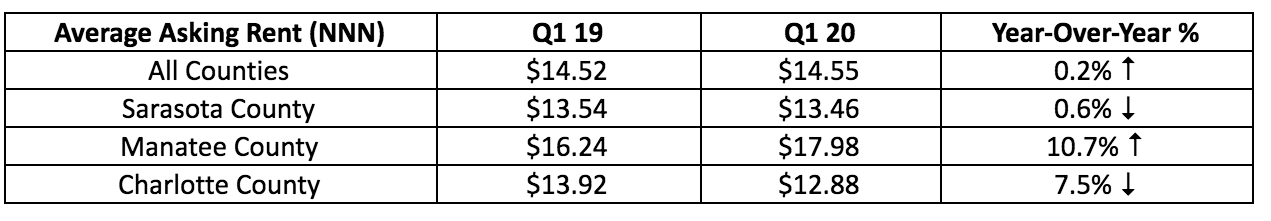

$14.55 PSF Average asking rent (NNN) ↑

*Arrows indicate change from Q1 19.

Rental rate table:

Space Availability by Type Chart:

Space Availability by Type Chart:

Land

The median price per square foot/acre of sold parcels for commercial-, industrial-, and residential-zoned land from the past four quarters are below:

Commercial Land:

$6.23 Per Land SF / $271,386 Per Acre

Industrial Land:

$4.99 Per Land SF / $217,248 Per Acre

Residential Land:

$2.07 Per Land SF / $90,000 Per Acre

Multi-Family:

The tri-county area remains in a supply boom. Construction activity has remained above the national average over the past seven years. 2,800 + units are currently under construction.

Occupancy Rate:

90.2%

YTD Net Absorption:

589 Units

Average Effective Rent Per Unit:

$1,261

For more information on commercial real estate in Manatee, Sarasota and Charlottes counties please visit www.msccommercial.com or call 941.957.3730.