- November 24, 2024

-

-

Loading

Loading

Land Solutions Inc. CEO Randy Thibaut kicked off the Fort Myers-based commercial real estate brokerage firm’s Market Trends presentation last week by showing an image of a wild animal towering over a conference table on a giant screen behind him.

“I know you all want to just hear good news,” Thibaut told a crowd of roughly 500 who gathered in Estero for the annual state of the Southwest Florida real estate market confab.

“But we’re gonna talk about the big elephant in the room.”

Thibaut contends the real estate market in the three-county area — Charlotte, Collier and Lee counties — is flattening, the result of macro-economic dynamics such as rising interest rates, the potential for a prolonged trade war with China, evolving demographics and time.

“Need I say more? We’re nine years into what is typically a seven-year economic growth cycle,” Thibaut says.

He also believes, based on conversations with economists and data from the National Association of Realtors, the National Association of Home Builders and John Burns Real Estate Consulting, that the market is in the midst of a profound shift that will impact the region for the next several years.

Rising interest rates — some analysts predict they will go as high as 5.8% by 2020 — and tariffs that are adding about $9,000 to the cost of a new home will almost certainly impact sales, he says. Impact fees will, too. In Collier County, Thibaut maintains they account for as much as 20% of the price of a new residence.

“These things affect people’s buying decisions,” he says. “Millennials and Generation Z are used to 1.3% interest rates on mortgages. What’s going to happen when they go up to close to 6%?”

He notes that on a home priced at $275,000, a one percentage point hike in interest rates equals $20,000.

“When the dust settles all the millennials and the first-time home buyers and the value-conscious baby boomers are going to have to decide whether they want to purchase a home or rent an apartment, and guess what? The apartment guys are going to get really aggressive.”

Industry consolidation will hit the market too, now that a trio of builders — Lennar Corp., DR Horton and Pulte Homes — control roughly 35% of the total Southwest Florida home market.

By way of example, Thibaut notes that Lennar, Pulte, Stock Development and Taylor Morrison recently teamed up to acquire a loosely affiliated tract of 3,820 acres in Fort Myers for a combined $114.3 million. There, they will build hundreds of new homes and sway buyers with various price points, amenity packages and other benefits for years to come.

He also predicts that labor, already in short supply throughout much of the Gulf Coast, will erode further in the months ahead as builders shift their focus to rebuilding the Florida Panhandle in the wake of Hurricane Michael.

Many of those laborers will likely not return to Southwest Florida, he believes, mirroring a similar phenomenon that happened more than a decade ago.

To counteract that shortage, builders will need to entice workers with higher salaries and bonuses, which will further drive up the price of housing.

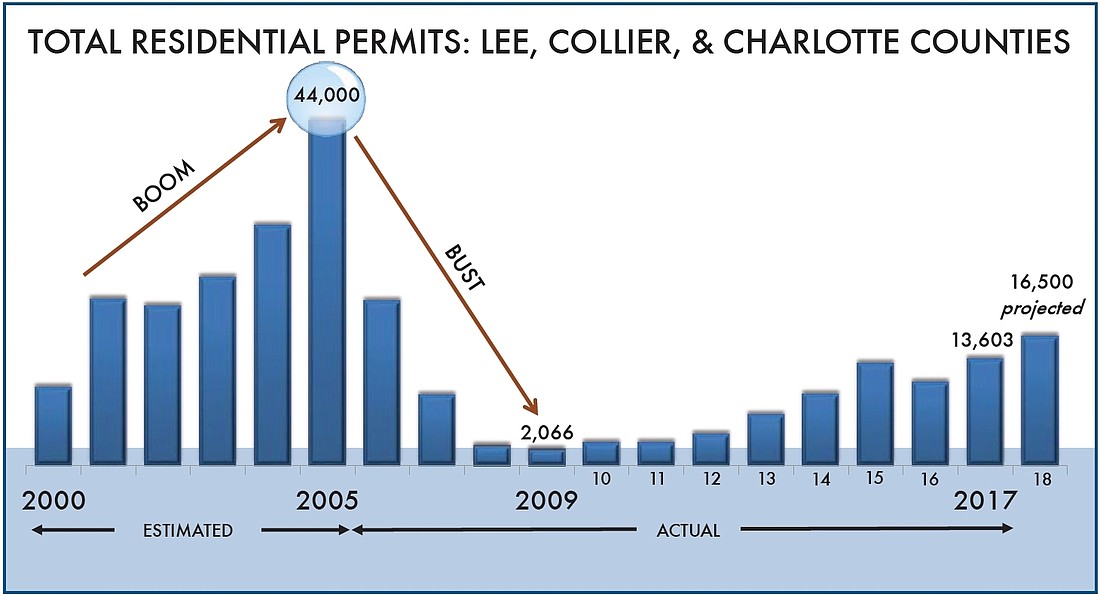

At least for now, though, the number of residential permits being pulled in the three-county area belie Thibaut’s dire assessment of the market’s future.

Land Solutions expects that for all of 2018, permits in Charlotte, Collier and Lee counties will top 16,500 — marking the eighth time in the past nine years that permit numbers have increased vs. the year prior.

If the number does reach 16,500 this year, that figure would be 21% ahead of 2017 — and the highest amount since 2006, according to data compiled by the firm.

Thibaut cautions, however, that much of the projected increase will come from the development of assisted living facilities and multifamily rental apartments, which skew the figures somewhat.

Still, he tempers his warning by noting that Southwest Florida’s economy remains robust overall, with solid job and population growth that boost both residential and commercial real estate.

“We’re not headed for a depression, we’re not headed for a real estate bubble that I can see,” he told the audience. “Recession is too strong a word to use, too. I do see a correction on the horizon, though, and it’s probably already started.

“But we don’t have mayhem; we simply don’t have the ingredients here for mayhem,” Thibaut says. “So you don’t have to freak out. I think whatever bumps we have in store ahead of us we’ll be able to recover from them, we’ll be able to sustain them.”

It would be folly, however, to persist in believing that the region’s real estate market can continue with double-digit gains given the many factors that are creating friction, he contends.

“I don’t believe that 2019 will be so bad,” Thibaut says. “But there is change coming. Don’t put your heads in the sand.”