- November 24, 2024

-

-

Loading

Loading

The term “market research” conjures all sorts of business tropes: focus groups, phone and email surveys, secret shoppers, test markets for new products ... more focus groups.

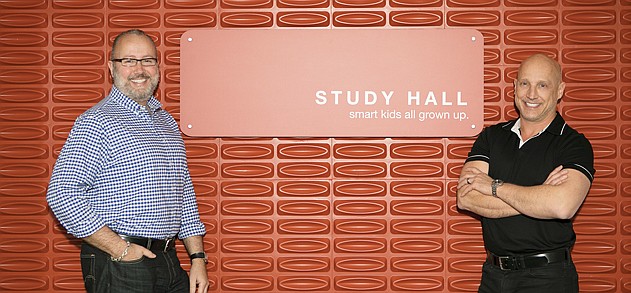

Rodney Kayton and Rob Illes, co-founders of Tampa-based Study Hall Research Inc., take a more scientific, creative and high-tech approach to market research. They do all of the above — but they also do a lot more, and their clients are rewarding them for it. The eclectic client list ranges from McDonald's to Microsoft, with Publix, First Watch and a host of others in between. The firm has 10 employees, a figure that shifts based on projects.

The company's slogan, “Smart Kids All Grown Up,” reflects Kayton and Illes' light-hearted approach to the serious work of helping companies make more money by better understanding their customers. “You know, back when you were in school there were always those really smart kids, and sometimes you wonder what happened to those people,” says Kayton. “We're sort of those people.”

Kayton, 52, could be considered the big brain of the company's back office operations, while Illes, 58 — a former ad man with Chiat/Day in Los Angeles — brings the street smarts to the client side of the business, crisscrossing the country to meet with brand managers and chief marketing officers at some of the most recognizable Fortune 500 companies.

“Until recent years, market research wasn't really a career path,” says Kayton. “People just fell into it in a variety of ways.”

Kayton's path started with a company that conducts what's known as “field research, you know, we're out there testing products, whether it's new razor blades, cell phones, whatever it may be. I became steeped in research and methodology.”

In a twist of fate, Illes became a client of Kayton's company. He continued to retain its market research services as his advertising career took him all over the country, from Los Angeles to New York, Minneapolis and finally Tampa, where the two longtime business associates combined their strengths to form Study Hall.

That was in 2010. The company has since seen robust growth.

Last year was Study Hall's second-best year in terms of total revenue, company officials say, behind only 2015. While executives decline to disclose specific annual revenue figures, most of their contracts to do research for clients range from $20,000 to $50,000. On a percentage basis, year-over-year revenue increased 26% in 2017, and 42% in 2015. Revenue rose 6% in 2016 over 2015, which is why Illes, in an email, calls the company, “a sometimes-cyclical business.”

Illes says revenue per job is another key growth metric. With the exception of 2010, its first year in business, the past three years have been the company's best in terms of revenue per job, including an eight-year high in 2017.

Study Hall's “financial success is a combination of the number of client engagements we conduct each year — but also the contract value for each job,” Illes says. “We want to be doing more engagements with increasingly higher contract amounts.”

What Study Hall delivers to clients is a wide range of business intelligence reports. Some are derived from the aforementioned tactics — focus groups, surveys, etc. — but many are custom qualitative research experiences Kayton and Illes refer to as “alongs.”

There are all kinds of “alongs” — “shop-alongs, dine-alongs, drive-alongs, etc., where I would actually come and experience a brand or a product with you,” Kayton explains.

“Qualitative research is exploratory,” Kayton adds. “If you have a big idea and you want to narrow it down, we would take that into qualitative [research]. You could really explore something with a group of, say, 10 of your customers, or a competitor's customers if you're doing competitive intelligence research.”

Qualitative research can also involve in-depth interviews with executives, content evaluation and that classic technique from the cola wars of the 1980s — taste-testing. Study Hall handled 117 qualitative group studies and in-depth interviews in 2017.

The company also conducts quantitative and longitudinal research. Quantitative involves more number crunching. A quantitative study might collect hard data about customer satisfaction, advertising effectiveness or brand awareness. “It's what I call take-it-to-the-bank research,” Kayton says. “Qualitative is more touchy-feely.”

Longitudinal research involves long-term data collection and analysis based on the same questions or same respondents over time.

“Typically brands will put some sort of longitudinal study in place that just runs in the background, and what they would like to see is their numbers remain the same,” Kayton says. “They just want to know where they are versus their benchmark from a year ago or last quarter. And then they're also usually tracking two or three competitors.”

A typical nonlongitudinal research project lasts four to six weeks, “but it depends on how big the company is,” Kayton says, “and how many 'legs' there are to their questions. What do they want to learn? Is it a brand refresh? Is it a whole relaunch? Is it an entirely new brand? How many competitors are there? How many subsidiaries are there? Everything we do is built from the ground up, and it's all custom. We don't do what we call 'off the shelf' research.”

Study Hall's market research has won it an impressive stable of clients representing a wide variety of industries. The list includes Microsoft, McDonald's, Mercedes-Benz, Bank of America, UPS and Target, to name a handful. In Florida, it works with some big-name companies such as Baycare, Publix, Bay News 9 and the Orlando Sentinel.

The firm has also done work for Tampa-based fast-food chain Checkers and Rally's. “Study Hall Research has been a wonderful partner for many years,” Checkers and Rally's Chief Marketing Officer and Executive Vice President Terri Snyder says in an emailed statement. “They really understand our brand and consumer base and help us tailor research to our specific needs.”

Study Hall aims to add more local businesses. “We sometimes have trouble getting in front of local clients because they feel like they need to go to L.A., Chicago or New York to get world-class research, when really it's right here in their backyard,” Kayton says.

Illes says Study Hall isn't the cheapest market research firm around, but it's also not the most expensive. “With research, you get what you pay for,” he says. “But if a client is looking at research firms that are out of market, they're going to pay a premium price.”

In the 2017 fourth quarter alone, Study Hall conducted market research for CVS Health, Papa John's, Rally's and Checkers Drive-In Restaurants, the Pinellas Suncoast Transit Authority and six other clients.

Kayton says you can't read too much into the timing of a specific company's market research project. In his view, it's never a bad time to get smart.

“When the market tanks, or there's some big plunge, wise companies do more research to find out how to counteract that,” he says. “Dollars are shorter for their customers and they want to understand how to keep people purchasing. But even in the best of times, somebody can come along and eat you, like Amazon, so most companies will have some sort of ongoing research function.”

Tampa-based Study Hall Research works on a wide variety of projects for a varied list of clients. Some recent projects include:

• A series of three separate rounds of qualitative studies for strategic food development and taste-testing for Tampa-based Checkers and Rally's Drive-In Restaurants;

• A comprehensive online quantitative consumer preference study, focused on a growing market region for daytime cafe brand First Watch;

• Qualitative group studies in Medicare and Medicaid in Florida, Illinois and California for Tampa-based managed care firm WellCare Health Plans; and

• A series of in-depth, one-on-one customer dine-alongs for business development at Westlake Village, Calif.-based Sharky's Woodfired Mexican Grill.