- December 13, 2025

-

-

Loading

Loading

When you first start a business, you might not be thinking about the day it's time to sell.

But you should be.

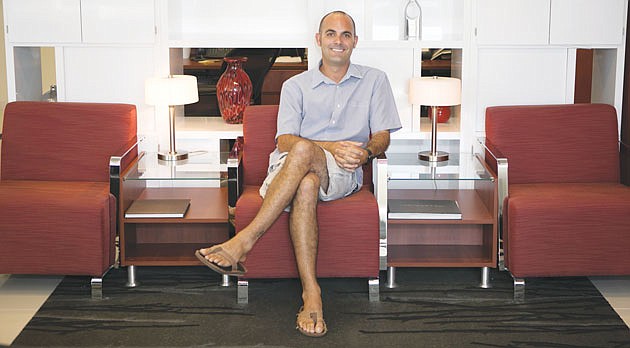

“You have to understand what your destination is,” says Bert Seither, CEO of The Startup Expert, a St. Petersburg-based firm that provides coaching and other assistance for entrepreneurs. “If you want to exit out of the business at one year, three years, or 20 years, you need to make decisions for your business based on what that destination is. The fact that people should be planning an exit strategy is ridiculously important, but no one does it.”

Proper planning helps when it comes time to value your business for a sale — and helps get the best price. Seither knows of what he speaks. The serial entrepreneur started Tampa Bay Drone Photography in 2015, seeing an opportunity to get into the drone space in its early days.

But he wasn't in it for the long term. “I never wanted to run an aerial photography company,” he says. “My exit strategy was about two years. I was able to position myself as a leader in the market to get media attention and get on the news. I did things throughout those two years that would make the business attractive to potential buyers.”

Multiple factors come into play when determining the value of a business. Keeping detailed records is key, because that helps figure out things like discretionary earnings.

“It sounds basic, but you wouldn't believe the number of businesses out there that don't have good records,” says John Davis, founding partner at Davis & Associates, a Bonita Springs accounting firm that does business valuations along with other services for businesses and individuals.

He says sellers need to know their earnings before interest, depreciation, taxes and amortization, or EBIDTA. The value of their business is generally a multiple of that, which could range from two to five times or more, depending on the industry and other factors. “Basically what you're doing is calculating the cash flow of the business and then deciding how much of a premium someone would be willing to pay for that cash flow,” says Davis.

There are other business-specific factors. A one-person business can be harder to sell, for example, and therefore priced lower than one with a solid team and systems in place.

Salvatore Urso, president of Tampa-based business appraiser Ameri-Street Advisory, says something such as a Subway sandwich shop can sell quickly because its operating guidelines mean the owner doesn't have to be on site 24-7. “The more you take yourself out of the business and the more you make it autonomous, the more value there is and the easier it is to sell,” Urso says.

If the business founder stays around to help with the ownership transition, that can also bump up the sales price, Seither says. “This puts potential buyers at ease,” Seither says, “to know they're not going to be handed the keys to the car and have no clue how to drive stick shift.”

GO HIGH

Some tips to get the best value when selling a company include:

• Plan the business valuation and sale three to five years in advance. That allows time to fix any problems that could turn off buyers;

• Maintain strong margins — the slimmer those are, the lower the value;

• Don't be over-dependent on any one customer, supplier or salesperson. “It makes it very hard to sell a business and makes it less valuable,” says Salvatore Urso with Ameri-Street Advisory in Tampa. “Figure out where your dependencies are and remove them.”