- November 24, 2024

-

-

Loading

Loading

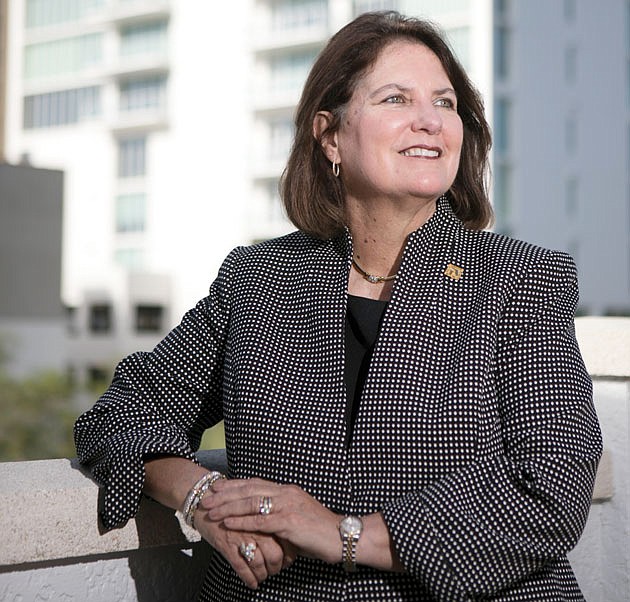

Rita Lowman, in what's basically Act 3 of a long and distinguished banking life, talks about her career today with the zeal of a new employee.

Lowman essentially has two banking gigs. She's chairwoman of the Florida Bankers Association, one of the more prominent lobbying and advocacy groups in the state. Lowman is the third woman in the history of the 130-year-old group to hold the chair position. At the same time, Lowman is president of Tampa-based Pilot Bank, a $293 million-asset institution with four offices in Tampa and a fifth location in Lakeland.

Both organizations in Lowman's orbit have been spinning quickly.

At the FBA, she's at the helm of a major initiative to inject the industry with more up-and-coming leaders. Dubbed Project 2020, the goal is to find bankers with the skills and experience to take on top roles at banks statewide in the next decade. “It's important to put a lot of time into training these new leaders,” says Lowman, 64, in an early December interview, because “these are the people who will be the C-suite executives when we all retire down the road.”

Lowman melded Project 2020 with another task at the FBA earlier this year, when she brought a group of 25 emerging banking leaders from Florida to Washington, D.C., for a lobbying trip. “I believe that experience really opened up their eyes to the opportunities they have” in banking, Lowman says.

That trip was one of seven Lowman took in 2017 to D.C. The reason behind the flurry of visits was to join bankers nationwide in fighting back against what they say is an over-regulated environment. “Are we asking for regulations to go away? Absolutely not,” says Lowman, whose FBA chairwoman term runs through June. “We want the government to be aware of what regulations are necessary.”

While the process to pare back regulations can be slow, momentum at Pilot Bank is rolling.

The positive developments include:

• Loans and deposits for the year are up 25%.

• The bank has enhanced its retail products and offerings.

• Plans are the works for an expansion to Pinellas County, possibly in 2018.

• Pilot closed on a $7.5 million capital raise in September.

In her role overseeing operations, Lowman says a focus has also been to make the bank, with some 60 employees, a top place to work in the region. One step there was creating a club and rewards system for high-performing employees, which Lowman says has been well-received. “We've accomplished a lot of goals this year at Pilot,” Lowman says.

Lowman was a founding executive at American Momentum Bank in 2006, which is now chartered in Texas with corporate operations in Tampa. She later helped grow St. Petersburg-based C1 into a $1.7 billion bank. Bank of the Ozarks acquired C1 in 2016 in a $402 million deal.

Those stops on her career were Act 2. Lowman's first go in banking was a 15-year stint at Bank of America, where, among other tasks, she helped NationsBank close or shrink hundreds of Barnett Bank branches in Florida. NationsBank acquired Barnett in 1997, and a short time later it merged with California-based BankAmerica, which ultimately become Bank of America.

Those years were valuable learning experiences for Lowman. At Pilot, while she's still learning, the value, she says, comes more in mentoring younger bankers and helping to position the bank for long-term success.

“When a company's vision and values and culture align with your own, it becomes a great place to work,” Lowman says. “And that's what I have at Pilot.”