- November 24, 2024

-

-

Loading

Loading

Executive Summary

Company. Nicopure Industry. Vaping, e-cigarettes Key. Company leads a fight against the FDA's new regulations

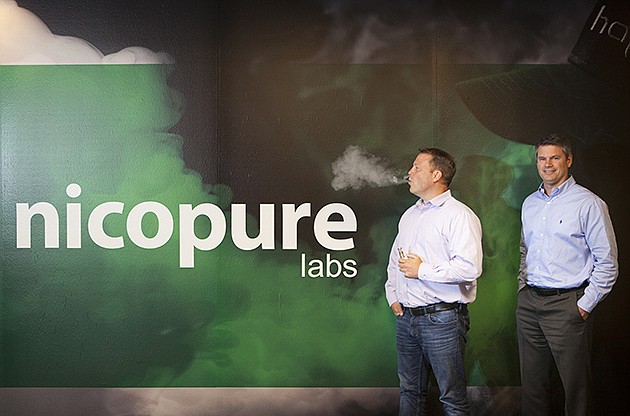

Nicopure CEO Jeff Stamler had concrete plans for scaling and raising awareness of his company's products nationwide.

Stamler purchased three RVs at the end of 2015 and rebranded them with the Nicopure logo. The plan for the Trinity-based company, which manufactures flavored e-liquids for the vaping industry, was to drive the RVs around for national advertising, using free samples to get potential customers to try the firm's vapor products.

“We've had the same goal since we started in 2009,” Stamler says, “and that's to help people switch from smoking cigarettes.”

Nicopure has grown steadily. The company declines to share revenue figures, but Jim Caci, Nicopure's chief financial officer, says its compounded annual growth rate since 2010 is 109%. Nicopure has a presence with its products in all 50 states and 90 countries, Caci adds.

But while the company is on a growth track, new regulations from the Food and Drug Administration pose grave threats to the entire e-cigarette industry. Stamler and Caci both say they are “not sensible.” One disputed portion of the rules: Manufacturers aren't allowed to share free samples, which dents Stamler's RV plan. Nicopure invested $350,000 in the three RVs.

Nicopure has taken an industry-focused leadership role in response to the regulations. A big step is a lawsuit the company filed against the FDA earlier this year. Nicopure, among other contentions, alleges the federal government is infringing on its First Amendment rights by banning it from making truthful non-misleading statements about vaping devices and e-liquids.

The suit attacks the FDA's so-called “deeming rule,” named because the agency “deems” e-cigarettes as regular cigarettes.

“We are challenging the FDA's deeming rule because of violations of the Administrative Procedure Act and the First Amendment to the U.S. Constitution,” Stamler says. He also says the rule will undermine the FDA's supposed goal of improving public health.

“This hurts the industry most by eliminating choice, competition and innovation,” Stamler adds. “There is something for everybody before this new regulation.”

FDA spokesman Michael Felberbaum says he cannot comment on an individual company and its products. He also declined to comment on the specifics of the Nicopure lawsuit.

'Bad regulation'

The deeming regulations were finalized May 5, Felberbaum says. Effective Aug. 8, the regulations, according to FDA documents, require “manufacturers of all newly regulated products to show that the products meet the applicable public health standard set forth in the law and receive marketing authorization from the FDA, unless the product was on the market as of Feb. 15, 2007.”

In essence, the FDA, under the deeming rules, want to make e-cigarette companies follow the same laws as tobacco products companies. Products on the market prior to the 2007 date are grandfathered in, per the Tobacco Control Act of 2009.

New products can be sold for two years from Aug. 8 while companies submit applications, and they can be sold for an additional year while the FDA reviews each application.

Stamler and other e-cig company executives say the new rules are overkill. “We're all for sensible regulation,” Stamler says. “We think this is bad regulation. It deems our products as regular cigarettes, and that simply isn't true.”

Along with banning free samples, e-liquid manufacturers cannot make statements like “no tar in our product” or introduce any new flavors without FDA approval, Stamler says.

Nicopure officials, simply and bluntly, believe the deeming rule will kill the industry. “Sensible regulation takes the bad players and uncertainty out of the market,” Stamler says. “Bad

regulation adds uncertainty and hurts innovation.”

Steve Miller, marketing specialist at Tampa-based White Cloud Electronic Cigarettes, echoes that statement. “The reality is that the deeming regulations, the way they stand, will eliminate a majority of the industry,” Miller says. “And that's an understatement. Some people say it will take out up to 99% of companies in the industry.”

The key industry killer: costs. Before being marketed and sold, every product SKU (stock keeping unit) created must go through a Premarket Tobacco Application process. The FDA says each PMTA will cost a company between $100,000 and $500,000. But industry analysts say that is significantly under-priced, and each PMTA could cost between $3 million and $5 million, Miller says.

Every different flavor, nicotine level and type of vaping device makes up a separate SKU. Even a different colored device requires a new SKU. Nicopure has 2,400 SKUs, Stamler says. That means it would need to pay up to $9 billion to keep all of its SKUs on the market.

The money and time to file a PMTA is the start of the lengthy process. So lengthy that Stamler and Miller say the FDA has only approved one PMTA, for Swedish Snus, since the Tobacco Control Act was introduced in 2009.

Focused on growth

Nicopure has aimed to be a premium provider of e-liquids and a leader in the vaping industry since the company was founded in 2009, Stamler says. For example, it doesn't use an organic compound called diacetyl in its liquids, which provides a buttery taste but is known to be harmful when inhaled. The company was also one of the first in the industry to introduce expiration dates and locking caps on liquids. “We've always opted for a short-term sacrifice to stay responsible,” he says.

Nicopure currently has about 50 flavors, all of which come at different nicotine levels. With the price estimates per PMTA, having that many options would no longer be an option. But Nicopure has a clear cut top two — a menthol flavor and an original tobacco flavor called Tribeca — that would be focal points for sales and marketing.

Despite the waiting game with pending regulations and its lawsuit, Nicopure is spending big moving forward. The company is prepping to file at least one PMTA in 2016 when the regulations go live, Caci says, and has bolstered its staff in the process. It has five employees for regulation and is hiring between 15 and 20 employees for various other positions, Stamler says.

Based on past growth and a solid financial position — regardless of the result of its lawsuit — Nicopure expects growth to continue and is adding space to accommodate that.

It just added a 10,000-square-foot clean room to its manufacturing facility in Gainesville, giving it 110,000 square feet total, Stamler says. The room, which cost between $3.5 million and $4 million, is the highest standard clean room for preventing contamination, Caci says.

Additionally, Nicopure is investing $1 million in filling equipment, $1 million in an enterprise resource planning system and $800,000 in mixing and analytical equipment. In total, the company is investing more than $7 million in its Gainesville facility.

Nicopure is also investing big money in a new corporate headquarters, Stamler says. The company is still picking an architect but plans to build an 80,000-square-foot facility in Trinity in Pasco County that will cost between $8 million and $12 million.

Reason to believe

A hearing on Nicopure's lawsuit with the FDA is scheduled for Oct. 19, more than two months after the deeming regulations kick in. But there is a sense of optimism that change will come before that date, Miller says.

He is referring to the Cole Bishop Amendment, spearheaded by Rep. Tom Cole, R-Oklahoma. The amendment calls for the grandfathered-in date to be moved to Aug. 8, Miller says. That would be a significant change of events.

“I'm extremely hopeful that the amendment will pass,” he says. “I believe the chances are good because it's a good idea and a good product. But as far as the FDA saying the PMTA process goes on the back burner, I don't see that happening.”

Postponing the date helps. But anything produced after Aug. 8 would still need to go through the PMTA process. That will still stifle innovation, Miller says, because small companies and vapor shops that make in-house custom e-liquids still can't afford to pay for PMTAs. “If the amendment works, the vapor industry will remain as we see it today, with the loss of innovation as a major caveat,” Miller says.

He also points out that the government traditionally doesn't work quickly, and that's a problem for White Cloud, Nicopure and the entire industry. It's a matter of making the changes sooner rather than later.

“If they change it in 19 months, and we've gone that long into creating our PMTAs, that money is never coming back,” Miller says. “Even if they do change it, I don't see the government saying 'hey sorry guys' and writing us a check.”

(This story was updated to reflect the amount of regulations in the e-liquids industry prior to the deeming regulations. It was also updated to reflect the correct total value of e-liquids SKUs in the marketplace and the average cost of Premarket Tobacco Application on an e-liquid product.)