- November 24, 2024

-

-

Loading

Loading

The number of medical inventions that never make it to market due to a lack of funds drove Tampa business consultant Douglas Martin to start a medical device company.

Martin's core idea: focus on the “toe of the hockey stick” in a product development curve. That's when an idea is ready to go through a patent filing, prototype creation and initial manufacturing, all the way to FDA approval, Martin says. This is typically when an inventor becomes overburdened by overhead, especially with the wait time for approvals.

The company, Tampa-based Medical Device Investments, aims to combat this holdup by simultaneously concentrating on multiple products in different stages of development. In doing this, MDI shifts the risks from the inventor to its own ledger. That's because the MDI owners take on most of the regulatory and development costs.

The founders are confident this risk will pay off.

“There are a lot of great products sitting on a shelf by a serial entrepreneur because they ran out of money,” says Medical Device Investments co-founder Allen Craig. “We want to fix that.”

After MDI licenses a device or technology and helps it get to market, the goal is to ultimately sell the patent to industry giants, including Johnson & Johnson, B. Braun and Cardinal Medical. The company concentrates on practical medicine, products that apply a new twist to an already patented device — which is a lower risk investment.

The strategy isn't totally novel. “We're applying what the pharmaceutical industry has been doing for a while to the lower end of medical devices,” says Martin.

The team has spent the last 18 months building MDI's portfolio. That now includes six products from Moffitt Cancer Center and two products from the University of Michigan. The executives believe they are capable of taking on 12 products at a time. Assuming four product exits a year, they plan on an IPO within three years.

A big part of the business model is to provide initial funds necessary to bring the device to market. The executives are currently working to raise $5.3 million to do that for two products. To date they've raised about half their goal, with the money coming from high-net-worth investors, mostly in the area. The co-founders decline to share how much they have invested in the company or products, but they are all working full time and haven't taken salaries yet.

The company, to build the portfolio of products, tries to set itself apart from angels and other investors. For one of the Moffitt products, a tracheal tube, the team competed against Kimberly Clark and another startup. Kimberly Clark would have charged Moffitt a royalty that the institution would have to closely track, and would deduct any development costs incurred. That's not the model at MDI.

The biggest challenge, say MDI executives, is to stay focused and bring what they have to market without getting distracted on other opportunities. Says Martin: “We have to avoid the raven syndrome of chasing the next shiny object.”

This story was updated to reflect the correct name of the company.

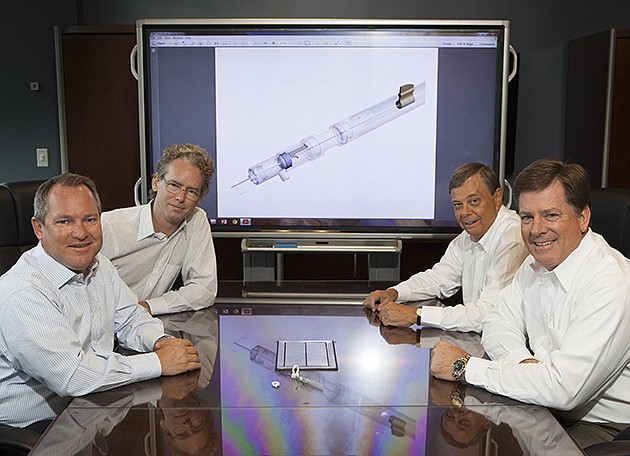

Fantastic Four

The four founders of Tampa-based Medical Device Investments each bring a set of skills to the startup. The founders include:

Allen Craig: The chief marketing and sales officer at MDI has experience with several big medical device companies;

Scott Hampton: The chief scientific officer, he has experience in securing FDA approvals on a number of patents;

Douglas Martin: The CEO of Medical Device Investments, Martin is a longtime business consultant and current board member at the Tampa Bay Innovation Center;

Matthew Miller: Executive vice president of investor relations and business development, Miller has an investment background. He's helped five medical device companies go public on the NYSE.