- November 25, 2024

-

-

Loading

Loading

Ever since Publix Super Markets Inc. developed into a grocery powerhouse, Lakeland has been an epicenter for distributing goods in Florida.

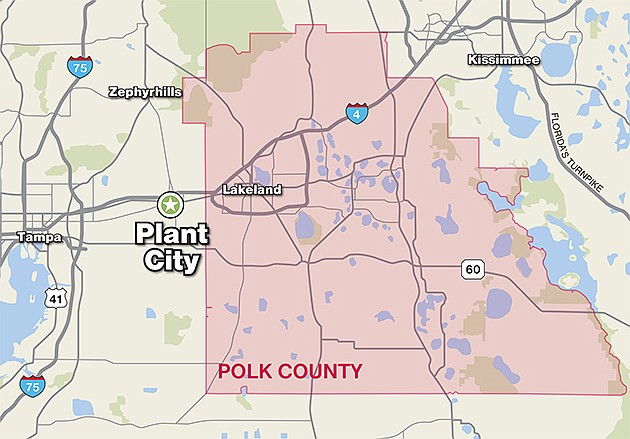

And for good reason: The Polk County city, with its proximity to Interstate 4 and its central, mid-state location, represents an ideal place to ship everything from fresh food to cat litter to nearly 19 million Floridians with a day's drive.

Lakeland's cache gained even more street cred last year when online retailing giant Amazon plunked down a 1 million-square-foot distribution and fulfillment center there, one of two in Central Florida.

But with Lakeland's success has come higher land prices and logistical challenges. That's prompted more than a few companies to consider neighboring Hillsborough County - and more specifically, Plant City.

Problem was, for years Plant City appeared to focus more on being North America's strawberry capital than it did on being a hub for transport-based commerce and development.

That is changing, though, officials and commercial real estate industry watchers say, and could lead to Plant City emerging as a critical piece of many companies' supply chains in the years to come — especially for users needing 100-acre sites or larger.

“Plant City is primed. It's been largely forgotten, but that's going to change,” says Rian Smith, a first vice president at commercial brokerage firm CBRE Group Inc. in Tampa. “We're seeing large box users come in, we're just in the early stages of it. All of what made East Tampa and Lakeland great distribution hubs is present in Plant City.”

Smith and others point to $3.5 million in new water and sewer infrastructure that will be completed next year on County Line Road as proof of the municipality's commitment to luring business — and jobs.

“Plant City is sending a message to the private sector that we are open for business,” wrote Mike Herr, city manager of Plant City, in a recent email.

Developers are noticing, and planning speculative industrial projects there for the first time in more than a decade.

“We feel like the location and the timing are right,” says Jeff Lucas, whose Central Florida Development is building a 100,000-square-foot spec industrial project in Plant City that will be completed next month.

“Lakeland has held the interest of logistics companies for decades, and East Tampa has had similar success, but the market is now receptive and users are looking in the Plant City area,” says Bob Appleyard, a developer with Lakeside Station LLC. His firm is developing 1,400 acres near I-4 in Plant City known as the Lakeside Station Logistics Park that is zoned for up to 11 million square feet.

“We've been patiently waiting for the stars to align,” adds Appleyard, whose firm originally received development approvals in the 1990s.

Much of the new demand has come from a cluster of industries, namely e-commerce retailers and food distributors, looking for buildings with higher ceiling heights, amped-up electrical power supplies, ample dock doors and parking and large tracts on which to build.

“With a few exceptions, if you're a user in need of 100 acres or more, there aren't many sites,” says John Dunphy, a senior vice president with brokerage firm JLL, which is leasing a trio of properties in Plant City and Lakeland on behalf of Heritage Equities of Atlanta.

Likewise, few believe Lakeland's appeal will diminish anytime soon, fueled by expansions by Rooms To Go, FedEx and others. Walmart is believed to be searching for land for up to 2.5 million square feet of e-commerce fulfillment space in Polk County.

In all, e-commerce merchants, parcel delivery firms and logistics operators are expected to need another 5 million square feet of distribution space in Central Florida in the next three years, a recent CBRE analysis shows.

That, in turn, has prompted new spec development in Lakeland's International Commerce Park and at the planned Lakeland Logistics Center.

“It's created a real needle-mover opportunity,” CBRE's Smith says. “The area is on national users' radar screens now.”

“We're tracking 22 Central Florida deals of 100,000 square feet or more,” says JLL's Dunphy. “In my 25 years in the real estate business, I've never seen it like this.”

A fresh take on real estate

Welcome to the Business Observer's refreshed commercial real estate coverage.

With this new format, we hope to build on the Gulf Coast transactional data you've come to value and expect. We also hope to augment it with critically important leasing information and other material that will detail trends, outline where businesses are going and why, and provide insights from key decision makers and industry leaders throughout the region.

At the same time, our commercial real estate coverage 2.0 intends to spotlight one key transaction weekly in these pages that speaks to market direction, offers a glimpse into entrepreneurial innovation, stands out for its sheer size or simply is fascinating in its own right.

Perhaps most important, we'll add a human element to our coverage, showcasing weekly an individual whose contributions to the Gulf Coast commercial real estate sector are extraordinary, unusual or worthy of special recognition.

But to do so, we're going to need your assistance. We ask that you send leasing information, people in new positions, news tips, suggestions for coverage or trend ideas to [email protected]. I can also be reached by calling 941-362-4848, Ext. 382.

We thank you in advance, and hope you enjoy the expanded offerings coming in the weeks ahead.

Tampa “bursting at the seams”

How hot is the Tampa commercial real estate market? Last year, $2 billion - yes, billion - in building permits were issued, according to Mayor Bob Buckhorn.

“Since 1987, I've never seen a chapter in Tampa's history like now,” Buckhorn told the nearly 400 who gathered for the CREW Tampa Bay's 7th annual Economic Summit earlier this month. “We're literally bursting at the seams.”

Buckhorn noted that Ybor, Riverwalk and the Channelside District are all bustling or have major, pending redevelopment plans in place.

“This will be a decidedly different place five years from now,” Buckhorn adds.

- K.L. McQuaid