- November 24, 2024

-

-

Loading

Loading

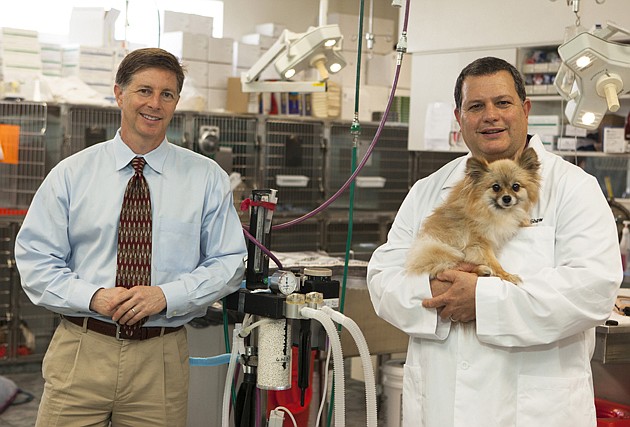

As a child, Neil Shaw wanted to be a veterinarian like his father, Brian Shaw. His oldest brother Darryl planned to be a businessman.

The brothers, now in their 40s, have realized their dreams. What they didn't foresee: their dreams would be intertwined.

They are partners in BluePearl Veterinary Partners LLC — a $100 million-plus specialty veterinary company started in 1996.

“If you'd asked me as a child if I'd work with my brother as an adult, I would have said 'absolutely not,'” says Neil, 45.

Darryl, two years older and CEO of Tampa-based BluePearl, also didn't expect to work with his brother.

But as new college graduates, they wanted to live in Tampa, their hometown since their family emigrated from South Africa when they were boys. Their father has owned VetCare Animal Hospitals, which has two locations in Tampa, since 1976.

Neil spent extra years at the University of Florida to learn to be an internist, while Darryl was obtaining an M.B.A. from Northwestern University.

Fresh out of college, the brothers decided to start Florida Veterinary Specialists in Tampa.

Big Change

In the beginning, Darryl answered phones, walked the dogs and did odd tasks, as needed. Neil, with the help of a vet tech, tended to the animals, offering specialized care not available at most vet offices.

For 10 years, the business was much like any other small vet practice other than its specialized care and 24/7 hours. Specialty services include cardiology, neurology, oncology and radiology with MRIs and CAT scans.

Business grew incrementally until 2006 — the year the brothers made a New York connection and took what appeared to be an incongruous leap.

A vet, who had just moved to Tampa to take over a retired doctor's practice, told Neil that New York City was in dire need of specialty vet clinics.

“He introduced New York to us,” Neil says.

The Shaws opened a hospital in Manhattan, which did well fairly quickly.

“We thought, 'Gosh, if we could do it there and be successful, why not elsewhere?'” he says.

The brothers had spent a decade learning the industry, and they knew there was a shortage of pet specialty care hospitals in most cities.

“We grew up in veterinary medicine, and we learned about specialty medicine by running a practice,” Neil says. “We learned how to apply those experiences and teach people.”

They learned they could establish the same customer-driven culture at satellite locations by giving on-site teams a sense of ownership. Quality care given with concern is the company's trademark, they say.

After the successful New York City launch, they added specialty care to an animal emergency hospital they owned in Brandon. They opened a Clearwater hospital and merged with a Kansas clinic owned by Dr. Jeff Dennis, a colleague in the small field of specialty vet medicine.

The company's lawyer, Nat Doliner of Carlton Fields, suggested they talk to two veteran businessmen who know what it takes to successfully grow a business: Barry Alpert, then managing director of investment banking at Raymond James & Associates, and Richard Dobkin, retired managing partner of Ernst & Young, Tampa.

Before long, the Shaws had established a board of directors that included Dennis, Alpert and Dobkin, and they were on their way to forming the foundation for the company's expansion.

In 2008, they changed the company's name to BluePearl Veterinary Care.

Switch to growth mode

“An informal lunch is how it all started,” says Alpert, an entrepreneur with strong ties to the Bay-area business community.

Alpert, now a senior vice president at Raymond James, started and sold insurance companies and banks. He also helped found St. Petersburg's Florida Holocaust Museum and Clearwater's Ruth Eckerd Hall.

“They were in a unique position to grow,” Alpert says of BluePearl. “It was a whole new science in a way.”

As for how the company would pay for its expensive growth, the directors created a system of shared ownership with the vets and medical directors. Darryl declined to discuss specifics, but Alpert says BluePearl shares ownership with the hospitals it acquires.

“We bring to them the foundation, what we call the gold standard of treatment,” Alpert says. “Our reputation is extremely high throughout the country. That's terribly important.”

Another key to BluePearl's growth, Neil says, is it reinvests most of its profits.

The company's strategy is simple, Alpert says. BluePearl aligns itself with primary care vets, who refer sick pets in need of specialty care.

BluePearl's vets have mended the broken foot of a Komodo dragon, removed a four-pound hairball from a tiger's stomach, scoped the entrails of a dancing bear and removed 111 pennies from a Jack Russell terrier's belly.

They even performed an MRI on a coral shark — not a typical BluePearl patient — a couple years ago. (The shark was asleep under anesthesia.)

After BluePearl treats an animal, it returns to its regular vet for routine visits, including vaccines and physicals. BluePearl won't compete with the referring vet, which it considers its customer along with the pet and its owner.

Demand for specialty vet care is expected to continue to rise as Americans increasingly place a higher value on their pets' wellbeing, Darryl says. More than half of all people in the U.S. have pets, and they're more willing to spend on big-ticket treatments such as radiation therapy or complicated surgeries, which can cost thousands of dollars.

“It's an unbelievably wonderful business model,” Alpert says. “The reason it works is the quality at the top. The tone at the top is what sets every organization apart. These doctors do it because they care, not just because they want to make another buck.”

Today, BluePearl has 31 hospitals in 12 states, including Georgia, Michigan, Minnesota, Tennessee, Texas, Virginia, Kentucky, Illinois and Missouri.

Between 2009 and 2011, BluePearl grew revenues by 170%. In 2012, revenue surpassed $100 million. (The company declines to publicly disclose revenue since 2011.)

Now, Darryl says the company wants to grow strategically. He says that means making the right decision with each practice it adds without feeling pressure to meet a predetermined target.

For now, there's little competition other than sole practitioners and VCA Animal Hospitals, a national public company that offers emergency care and also competes with general practice vets.

Eventually there will be more competitors, Alpert says.

“We made this industry,” he adds. “It didn't exist before us.”