- November 25, 2024

-

-

Loading

Loading

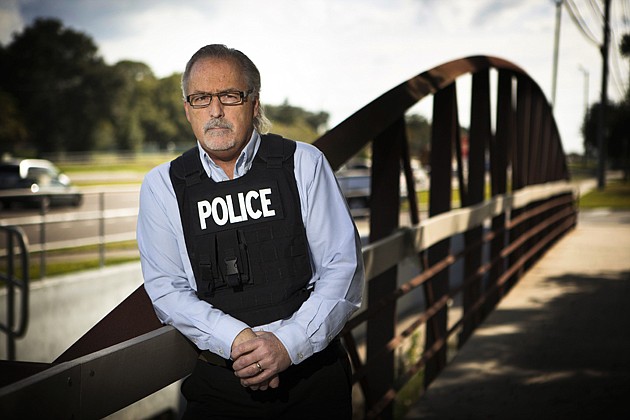

If you ask BlastGard International CEO Michael Gordon about his company's proprietary product, BlastWrap, he'll say it has potential to be used in a variety of ways to save lives and improve security. But Gordon will also admit, with some defeat, the most predominant use of BlastWrap to date: to ''bomb-proof” garbage cans.

BlastWrap is a product stuffed with beads of volcanic glass and Perlite, the foam-like substance in potting soil. It works by using air-filled cells in the beads to dissipate the force of a blast, reducing damage to surrounding areas.

Gordon, 55, says the wrap could be used for everything from securing munitions storage buildings to protecting airliner fuel tanks from explosive blasts. But its only use so far has been to line trash cans in public places to protect people from potential hidden bombs.

In 2005, the agency that operates the Washington, D.C., subway system bought 190 trash cans lined with BlastWrap for all of its Metrorail stations. The price: $735,000, or $3,868 per trash can. The wrap is also deployed in New York City subway stations, Yankee Stadium and the United States Memorial Holocaust Museum in Washington, D.C.

But none of these sales has translated to profits for the Clearwater-based company, which is traded over the counter (symbol: BLGA; recent price: $0.024). From 2006 to 2011, the company endured six consecutive years of net losses, ranging from $88,000 in 2010 to $3.8 million in 2011.

Gordon says the problem is the firm has failed to crack into the military procurement system where it has the greatest chance of success. “I can't get in front of the right people,'' he says. “We're a small little company. We don't have any connections in D.C. We can't afford to hire a retired general (as a lobbyist).”

With mounting losses and dwindling capital, the firm needed a new strategy — and sales. That's when Gordon got a call from a member of BlastGard's investment firm in New York. He told Gordon a San Francisco company that supplied tactical gear to police agencies and the military was for sale and might be a good match for BlastGard.

The company was HighCom Security. HighCom sells the mundane, but critical, equipment that protects police SWAT teams and troops patrolling hostile places: armored plates for bulletproof vests, as well as ballistic helmets and shields.

Although HighCom had profit potential, the company came with some baggage. Its former owner's actions put HighCom's export license, a crucial element for foreign sales, in jeopardy.

The factors made HighCom a risk, but also an opportunity for BlastGard. In a deal completed March 16, 2011, BlastGard acquired 98.2% of HighCom's shares in exchange for BlastGard stock and $196,400 in promissory notes. The stock swap was an easy decision, Gordon says.

The deal “was our best chance, our only chance.'' says Gordon. “With HighCom, we could get financing. I didn't have a manufacturing plant and very little equipment.''

Gordon saw the acquisition as a way to give new life to BlastWrap. Not only would it infuse the company with much-needed sales and connections in the defense world — it also provided an opportunity to expand the BlastWrap technology to HighCom's existing products to make them better. “Without HighCom, Blast Wrap would have closed its doors,'' Gordon says.

So far, the strategy has worked. In its first full year as part of BlastGard, HighCom rang up sales of $3.2 million, which accounted for 94% of the parent company's total sales. Annual revenues went from $344,000 in 2011 to $3.5 million in 2012. BlastGard's $1.04 million in net income for the year ending Dec. 31 marked the company's first annual profit.

But, Gordon isn't giving up on BlastWrap. Rather, he plans to overhaul how the company markets the product. He wants to deal directly with big defense contractors that would install BlastWrap to defend against explosive blasts in Humvees, ships and other hardware.

HighCom now consumes 99% of Gordon's time and the company's operating capital. HighCom added 25 distributors this year to sell tactical gear.

Gordon projects that BlastGard International will hit $8 million in sales in 2014. HighCom also is counting on growth from budding research on lighter, but stronger, body armor.

But BlastWrap will likely remain a financial laggard. Gordon estimates the product will contribute $125,000 to revenues in 2014 from the sales of BlastWrap-lined trash cans. But that doesn't mean Gordon is ready to give up.

“BlastWrap is a passion (of mine) that will absolutely save lives,'' Gordon says. “I know 100 % that BlastWrap will save the lives of soldiers who hit IEDs (improvised explosive devices).''