- November 25, 2024

-

-

Loading

Loading

Allan Barberio, one half of the name behind prominent Sarasota accounting firm Kerkering Barberio, languished in retirement for seven years until he recently got a call about teeth.

Not his teeth, but a business that manages dental practices. Although that might not sound super sexy, in the case of Sarasota-based Sebring Software, the business, Barberio thought, has a juicy potential bite. In fact, Sebring founder Leif Andersen, whose executive career ranges from natural gas to bathroom fixtures, projects the firm could reach $100 million in sales by 2016 and $300 million by 2018.

That's a whole lot of teeth, considering Sebring, publicly traded over the counter (stock symbol: SMXI) had no revenues through May and projects a mere $17 million in 2013.

Andersen, however, says the opportunities for Sebring stretch wide. For one, the dental practice industry is going through a buying and consolidation period, with private equity money dangled like floss. Yet Sebring, says Andersen, offers dentists an alternative, and in many cases a more lucrative long-term option than other firms.

Andersen, who founded a sonar technology company he eventually sold to Toshiba, also brings a successful track record to Sebring. That history is partially how Andersen raised $66 million from Wall Street investment bankers for Sebring last year. “It's hard to get a financial commitment from Wall Street today,” Andersen says, “especially when you are a young company.”

The firm might be new to Wall Street, but Andersen, Sebring's president and CEO, says one more advantage it has is extensive business management experience. That, says Andersen, plus the company plans to use proprietary software to reduce the amount of money its dental practices spend on data entry.

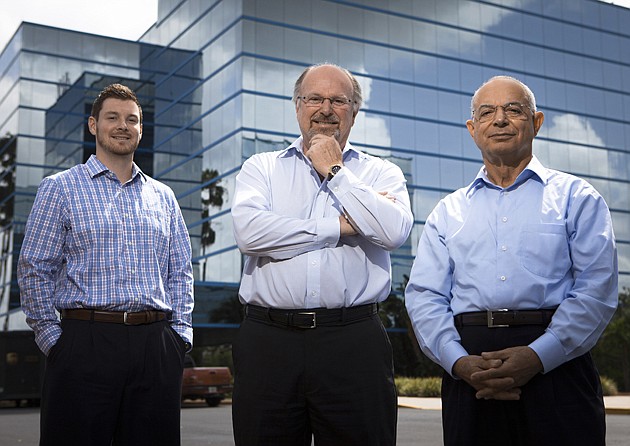

Barberio, who retired from Kerkering Barberio in 2006, when he was 61, was hooked. He met Andersen and Sebring Vice President of Operations Michael Andersen, the CEO's son, through mutual friends. Barberio joined the firm in April.

“I retired too healthy and too early,” says Barberio, now 68, and the firm's CFO, “and I couldn't wait to come out of retirement and help them build this company.”

Important approach

While the Andersens and Barberio work in Sarasota, Sebring also operates a dental management office in Clearwater with 14 employees, and all the practices combined have about 130 employees. The Florida practices include Orthodontic Specialists of Florida, which has offices all along the Gulf Coast.

Sebring currently has 34 dental practices in its portfolio, with 31 in Florida and three in Arizona. The firm's goal, says Michael Andersen, is to have 50 practices under management by the end of the year. The current focus is on Florida and Arizona, though the younger Andersen says the company would like to enter other Sunbelt states in the near future.

The practices Sebring owns and will buy in the future will retain the original names. But Leif Andersen says Sebring will brand the practices together internally through its software, a heavy emphasis on customer service training and a commitment to patient care that starts at the front desk. Andersen says he also wants to foster a patient-first philosophy.

“If you're driven completely by the spreadsheet when you deal with health care, you won't realize the optimum in clinical care,” Andersen says, “That's not the way to do it.”

That approach is important because while Andersen is confident in the company's plan, he's cognizant the dental practice management industry doesn't have a particularly high barrier to entry. “Managing dental practices didn't start yesterday,” says Andersen, who was born in Norway and grew up in Brazil. “It's been going on for decades. But we are doing it with a different model and a different twist.”

The twist, says Andersen, has two sides.

One is Sebring hopes to build a large enough enterprise so it can buy dental equipment and new technology for the practices at a lower cost. That, say Sebring executives, will make each practice more competitive in cost per patient.

The second side of the twist, a key part to the firm's long-term strategy, actually, is Sebring is like the anti-private equity player in the dental practice management sector.

And that sector is hot right now: There have been nearly a dozen major private equity transactions of dental practice groups since 2011, according to a report from Boston-based investment banking firm Provident Healthcare Partners. Transactions range in value from $68 million to more than $1 billion. “The sector continues to dominate the health care industry in terms of private equity investment opportunity,” the report states.

Sebring executives, rather than being scared off by that traffic, say the firm can poke through the holes private equity misses. For example, Barberio says Sebring won't squeeze every bit of profit out of a practice, like some other firms do, just to sell it in five years. Says Barberio: “We don't have pressure to sell any of our businesses.”

Andersen adds Sebring, unlike some private equity firms, looks back at four years of cash at a practice it seeks to buy, not only multiples of revenues. That helps tone down a big risk in the business: The trap of overpaying for a practice.

Solid partners

One further advantage for Sebring, hopes Andersen, is the company's nimbleness. After all, Leif and Michael Andersen, along with a third partner, founded the business in 2007 with a license to market a software program for the auto industry developed by a German company.

But the timing was off, given the troubles in the auto industry. “We got some traction with customers,” says Andersen, “but in 2008 and 2009 no one was spending any money.”

So in 2010 the Andersens switched to health care. The pair focused on dental practices, for the niche, and in 2011 Leif Andersen headed to New York to hit up Wall Street. Andersen, who has been a founder or top executive at more than 15 companies, met with several firms. One, Wellington Shields & Co., invested $50 million in Sebring. Another firm, MidMarket Capital Partners, invested $16 million in Sebring.

Even with solid financial backing, Sebring faces several challenges. One, says Andersen, is the risk of taking on too much money from investors before the right dental practice opportunity is in place. Says Andersen: “We want to avoid debt as much as we can.”

Another factor in terms of expenses, says Barberio, is Sebring has already spent well into the six figures in regulatory and compliance fees that come with being publicly traded. One more concern is how the dental industry fares in step with the overall economy. Andersen recognizes that, though he remains optimistic in the future of the market, and Sebring's strategy.

“This certainly isn't a recession-proof business,” Andersen says, “but I think people will always take care of their teeth, in good times and bad times.”

Knight Life

Sarasota executive and Norwegian native Leif Andersen, whose first name is pronounced “life,” has a unique non-business accolade on his resume: His Majesty King Harald V of Norway made him a Knight of the First Order in 2002.

The honor stems from the Winter Olympics held in Lillehammer, Norway, in 1994. Andersen, CEO of Sarasota-based Sebring Software, a dental practice management firm, lived in Salt Lake City back then. After the Lillehammer Olympics, Andersen was named an honorary consul for the Kingdom of Norway and a U.S. liaison for the Norwegian Olympic Committee for the 2002 Salt Lake City Olympics. He found places for his homeland's athletes to stay and train in Utah, and he oversaw the Norway House, where TV crews from back home worked.

The Knight of the First Order, says Andersen, is the highest honor a Norwegian citizen can receive.