- December 22, 2024

-

-

Loading

Loading

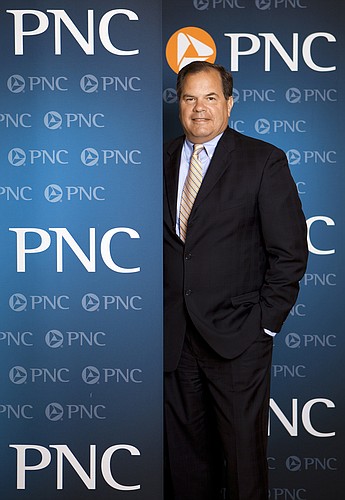

When PNC Bank executive Joe Meterchick received a Florida promotion call from his bosses a few years ago, he had some good reasons to reject it.

A big one: The banking industry in the Sunshine State was a jumbled cluster of failed banks, institutions under regulatory order and lenders desperate for capital. The shine of the early 2000s boom, when executive banking in Florida was a plum gig, had evaporated.

But Meterchick, a 30-year PNC veteran who at the time headed up the company's corporate banking unit in Philadelphia and southern New Jersey, decided to take the job. He had a vacation home in east Manatee County, for one. Plus the idea of building a business almost from scratch appealed to his sense of entrepreneurialism.

“The opportunity was to come down here” and repeat Pittsburgh-based PNC's success in northeast markets, Meterchick says. “I always wanted to come to Florida. There's a PNC on every block in Philadelphia.”

Market oversaturation isn't one of the challenges Meterchick faces — at least not yet. Meterchick, 53, accepted the Florida promotion last summer, and is now a regional president in charge of PNC Bank operations from Orlando to Naples. He is also the bank's director of corporate and commercial banking for all of Florida, which covers businesses with at least $10 million in revenues.

The challenge, instead of too many banks, will be for PNC to find its way in a crowded landscape of regional banks that already have a presence on the Gulf Coast. PNC is the eighth-largest bank in the country in terms of assets, with $298.4 billion through Dec. 31, according to research firm SNL Financial.

Two of PNC's closest competitors on the Gulf Coast, SunTrust Banks and BB&T, are 12th and 13th on the SNL list of the top 50 banks. Atlanta-based SunTrust has $176.9 billion in assets, while Winston-Salem, N.C.-based BB&T has $174.6 billion.

That makes for a congested marketplace, though PNC executives aren't intimidated. “Our strategy is to gain clients,” says Meterchick. “The winning banks are the ones with the most clients.”

Adds Melissa Mickle, a PNC retail banking area manager whose territory includes some of the Gulf Coast: “It's all about gaining a greater share of every one of our client's wallets. We don't want just a customer's checking account. We want to aid them in all of their financial goals.”

Of course, that's precisely what many of PNC's competitors go after.

But Meterchick says PNC is in a better position to get it done, mostly because it has a clean balance sheet. “We don't have baggage, because we stayed strong during the downturn,” says Meterchick. “We are one of the best capitalized banks in the country. We continued to loan money in the downturn.”

PNC's Gulf Coast presence is the result of three acquisitions over the last four years. In 2008, the bank bought Cleveland-based National City, which had wealth management offices in Sarasota and Naples. In June 2011, PNC bought 19 Tampa area BankAtlantic branches.

The bank's largest move into the Gulf Coast, and Florida, was also in June, when it bought the American retail operations of the Royal Bank of Canada for $3.45 billion. The deal included RBC's 424 branches in the Southeast, spread from Virginia to Florida.

PNC integrated the RBC branches in Florida into its network in early March. It was the seventh major conversion Meterchick has been involved with at PNC in the last eight years. “Every time you do that,” says Meterchick, “you get better with it.”

PNC Financial Services Group Inc.

Headquarters: Pittsburgh

Assets: $298.4 billion (as of Dec. 31)

Deposits: $209.2 billion (as of Dec. 31)

Services: Includes retail and business banking; residential mortgage; corporate banking; and wealth management.

Locations: About 2,500 branches in 16 states and Washington, D.C. About 40 brokerage offices in 12 states and Washington, D.C.

Gulf Coast branches: 43, from Pasco to Collier counties.

Source: SNL Financial, PNC Bank