- December 22, 2024

-

-

Loading

Loading

Here's the scenario that's likely playing out in the boardroom of every community bank in Florida.

Faced with increasingly burdensome regulations and lack of investor interest, the shareholders of community banks have little choice but to hope for a generous offer from a larger bank seeking to boost its presence in Florida.

The shareholders of Fort Myers-based Florida Gulf Bancorp got exactly that when IberiaBank announced on March 19 that it offered to pay nearly $44 million for the company that owns Florida Gulf Bank. That's about 1.4 times book value, significantly more than what Florida community banks have been trading for in recent years.

Whether the price sets a benchmark remains to be seen, but long-suffering shareholders of Florida community banks might finally be seeing an exit from the troubled sector. Indeed, offers for banks and thrifts in the Southeast in the past year have averaged just 81% of book value, according to SNL Financial.

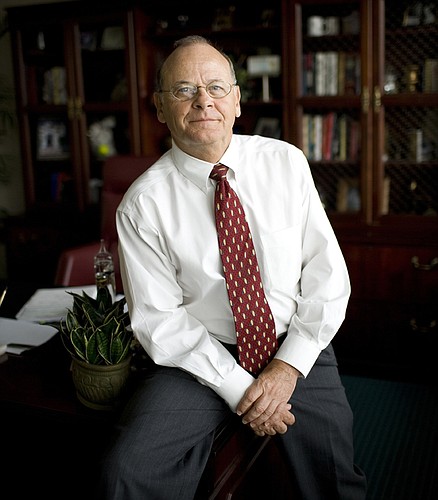

For a smaller bank like Florida Gulf with $350 million in assets, increased government mandates would boost expenses to the point of negating any improvement in the bank's operations. “We were being bombarded by government regulation,” says William Valenti, Florida Gulf's president and CEO. “We believe it will get worse.”

By contrast, IberiaBank reported assets of $11.7 billion as of Dec. 31 and posted net income of nearly $75 million in 2011. The Lafayette, La.-based bank entered the Southwest Florida market in November 2009 when it acquired two failed banks: Orion Bank in Naples and Century Bank in Sarasota. The Florida Gulf Bank acquisition fills in the gap between those two communities.

“Every time there was a federal exam, they said 'you need to add more people,'” Valenti says. Unfortunately, these extra employees weren't hired to generate new business. Instead, regulators demanded more staff to comply with a growing array of government regulations.

In addition, the government has ordered banks maintain a larger capital cushion. “The requirement used to be 5% capital; they raised that to 8%,” says Valenti. “That's a 60% increase.”

With future profits likely to be slashed by growing expenses to deal with government mandates, it's no surprise that community banks aren't finding investors to boost capital. “No one wants to invest in a community bank,” says Valenti. “We just don't see the return.”

In a sign that scale matters more than ever in this business, IberiaBank says it can generate returns in the “mid-teens” from the Florida Gulf Bank operations in part by eliminating duplicative back-office functions such as compliance. In a presentation to investors shortly after the announcement of the deal, IberiaBank says it can achieve $3 million in annual cost savings at the Fort Myers bank.

Florida Gulf Bank is one of the better-managed community banks. Besides surviving the downturn, Florida Gulf Bank earned $758,000 in 2011, more than double what it earned in 2010. Its bad loans are negligible, a result of conservative underwriting during the boom.

“What we like about Florida Gulf Bank is its great branches and its great people,” says Daryl Byrd, IberiaBank's president and CEO, who personally visited all eight of Florida Gulf's branches and named Valenti, 67, market president for Lee County. “We're paying them what we think is a fair multiple.”

Valenti says Florida Gulf's board of directors set an initial target of 1.5 times book value and began confidential negotiations with IberiaBank when an investment banker brought the two parties together. Besides IberiaBank, Valenti says Florida Gulf had three other suitors, though none made a formal offer.

While the currency for the deal is IberiaBank stock (which recently came with a dividend yield of 2.5%), there is an additional cash incentive of $4.4 million in cash if certain troubled loans pay off. If those loans work out favorably, Valenti says shareholders will realize the 1.5 times book value the board had set as a baseline.