- November 28, 2024

-

-

Loading

Loading

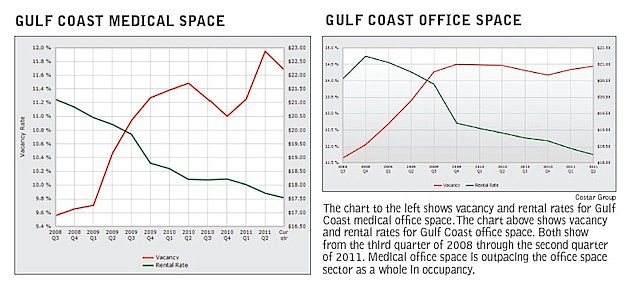

If the trend line for medical office space were a heart monitor, it might be time to get the defibrillator paddles. Although the sector is struggling, it appears medical office space recently hit a peak in vacancy rates that have been rising during the past three years. And during that time, it has also outperformed other commercial real estate sectors in occupancy.

According to real estate research from the CoStar Group, the medical office space market along the Gulf Coast has seen vacancies steadily grow from 9.5% in the third quarter of 2008 to 12% for the most recent quarter.

Southwest Florida, which includes Charlotte, Collier and Lee counties, has seen vacancies rise from 11.5% to 14.5% for the same periods. Vacancies in the Tampa Bay market, which also includes Sarasota and Manatee counties, have climbed from below 8.8% to 10.2%.

Mirroring that occupancy decline, average annual rental rates have fallen from their high by roughly $3 to $3.50 a square foot during the same period.

In addition to falling prices and rising occupancy rates, the time commitment of leases has changed as well. Steve Horn of Ian Black Real Estate says when economic conditions are tight real estate is usually a medical group's easiest cost to cut. He says that seven- to 10-year lease deals are becoming much more rare. Instead, medical groups are looking to sign two- or three-year deals, Horn says.

Despite their fall in the recession, however, medical office occupancy rates are looking healthier than the commercial office space as a whole. Southwest Florida office properties are currently reporting a 17% vacancy rate, and the office sector in Tampa Bay has a vacancy rate of 14%.

Looking more regionally, most of the Gulf Coast counties saw a brief pause in the occupancy and rental rates decline starting around 2010 that ended toward the middle or end of that year. For example, Pasco County saw vacancy rates dip to near 11% in the second quarter of 2010, but then saw them rise every quarter after until the second quarter of 2011, when they reached 14%. Lee County saw its rental rate bounce off the bottom ($15) in the fourth quarter to more than $15.50 and then slowly decline from there.

Two of the better performing counties, Hillsborough and Manatee, saw a spike in vacancies, 3.25 points and 4.25 percentage points respectively, in the latter half of 2009, which has since declined to near 2008 levels.

In general, medical office buildings located near a major medical facility are seeing greater stability and higher rents than their tertiary competitors.

“More often than not, on-campus [medical office buildings] and office campus MOBs across from [hospitals] seem to be holding up relatively well,” says Pat Kelly, the executive vice president and managing director of the Tampa office of Grubb & Ellis. “Buildings in niche locations seem to be suffering of late.”

Many brokers attribute this to medical group consolidations, which allow the new more diversified group to take larger and more prominent space.

In addition, uncertainty from health care legislation and the lack of certainty on reimbursements is causing many medical groups to be conservative in their terms.

“Most physicians don't have a long-term plan,” says Robert King, president of the Tampa and Orlando healthcare-focused firm RJ King & Associates Healthcare Real Estate Advisors. “[They] are looking to cut back. They don't know what their reimbursement rates are going to be in the next three months, let alone the next three years.”