- November 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

Business. Creonix, Manatee County

Industry. Manufacturing, electronics

Key. Firm has turned away from competing against companies that manufacture overseas, especially in China.

China nearly killed Ken Piela's cable wire and circuit board company. But some American ingenuity, a revamped and reenergized business strategy and, most importantly, a lot of dollars, seem to have saved it.

The company, Bradenton-based Creonix, is now primed to grow significantly. It's also the latest company to join a burgeoning local movement that one way or another aims to return manufacturing to the United States.

“We needed to be in new markets where the business would not go to China,” says Piela, president of Creonix. “This company would not have survived had we not changed our model.”

That model, says Piela, was previously manufacturing parts, boards and cables for a slew of commercial customers for just about any industry that walked through the door. The diverse customer base was an asset for Creonix, at least until it wasn't, when Chinese and other overseas competitors began to offer drastically lower prices.

The solution, Piela discovered, was to dive hard into markets that overseas companies and manufacturers can't, or won't, be in. For Creonix, that meant high-tech military and medical industries. “The military and medical business isn't going away,” Piela says. “And it isn't going overseas.”

To aid the mission, in late 2009 Piela set up a meeting with the firm's previous owner and KleinPartners Capital Corp., an El Segundo, Calif.-based investment firm. Piela, 61, knew of KleinPartners because years ago he helped it buy a bare-board circuit firm in Connecticut — another company that ran into competitive issues against China.

KleinPartners liked what it saw at Creonix. Managing Partner Greg Klein couldn't be reached for comment. But the firm's website says its investment criteria normally includes companies with revenues between $10 million and $100 million; companies with a successful history and established customer base; and companies with time-critical challenges.

KleinPartners bought Creonix in March 2010 for an undisclosed amount.

More money

The overhauled strategy at Creonix, originally named Creative Electronics, goes deeper than simply avoiding Chinese-dominated markets. Instead, the strategy encompasses buying new equipment, hiring the right people, finding new clients in untapped markets and growing via acquisitions.

On acquisitions, the company is already active. It made one purchase of a company last year. Piela declines to elaborate on the business Creonix bought because of privacy concerns for the proprietary technology. The company will likely make at least two more acquisitions in 2011, Piela says, and another one in 2012.

Moreover, Creonix, through KleinPartners, made a hefty investment in equipment. Piela declines to say how much the firm spent, only confirming it's more than $1 million. “They understood that in order to grow this company they had to put some resources in,” says Piela. “They put in money.”

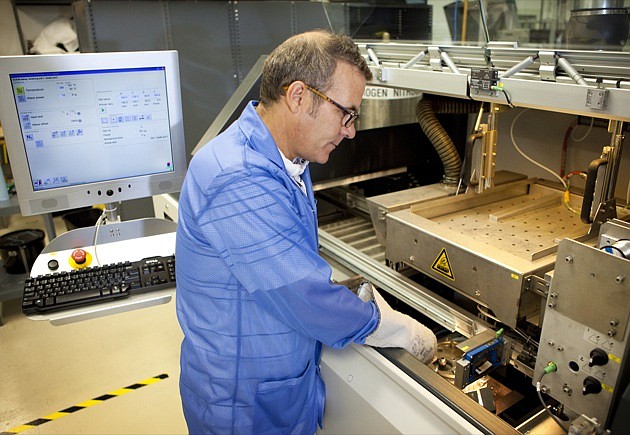

The purchases include two surface mount technology machines, which provide an efficient way to construct electronic circuit boards. The company also bought new cable and X-ray machines, in addition to a new automatic optical instrument, which Piela says is like a robotic quality inspection station.

Creonix then hopes to grow its employee base, currently at about 50 people, so the equipment goes to good use. On that front, the company will get a little nudge from Manatee County commissioners. The commission recently approved $121,000 in performance-based incentives if Creonix follows through on roughly 50 new hires by 2016.

Creonix must also sign a long-term lease for space in the county and spend money on property improvements in order to receive the subsidies, says Manatee Economic Development Council Executive Director Eric Basinger. “We are really glad to keep them in Manatee County,” says Basinger.

Piela says the company's revamped business model will be the catalyst to meet the expectations. “We want to have the most sophisticated equipment on the market and the most talented people available to run the equipment,” Piela says. “Quality is essential.”

Outsource issues

Quality issues have forced several Gulf Coast companies to rethink China. While Creonix doesn't manufacture goods in China, plenty of other firms have. Some still do.

And quality control is a big sore point, no matter the product or the industry. Shaw Development, a Bonita Springs firm that manufacturers fuel systems, caps and other parts for a variety of vehicles, experienced that issue firsthand in 2009.

Shaw Development President and CEO Kevin Hawkesworth says back then his Chinese manufacturer used incorrect machines and tools during the assembly process on one specific order. “If a tool craps out or produces defective parts,” Hawkesworth says, “they might not tell you.”

The defect turned into a costly, and useless, shipment.

Hawkesworth soon committed to get out of China. He had been doing business there in some form for a decade, but the problems, he decided, “weigh against the low costs you can get there.”

Shaw Development has since bought an injection mold company in Naples. The quality of the tools and the final products is vastly improved, Hawkesworth says. Plus, now he can monitor inventory more precisely, where in the past, in China, he had to buy in high volumes early in the buying cycle.

Executives at Palmetto-based Sleek Audio likewise hit a Chinese wall when it came to quality control in Asia. Sleek Audio, founded in 2004, manufactures and sells a line of high-end “in ear” earphones. The company has grown in space, sales and employees the past three years, even through the recession.

But even amid the growth, father-son executives Mark and Jason Krywko halted production work in China. There were the control issues, for one. Moreover, shipping isn't as cheap as it once was, the time difference makes on-the-spot corrections difficult and travel to get there and back is time consuming and expensive. Sleek Audio now works with a Manatee County firm for production.

That decision generated some extra publicity for the company. The Krywkos spoke about it on an interview with Fox Business News in February, where they mentioned how they had to trash a Chinese-made shipment with defects. The mistakes cost the company millions of dollars. Wired magazine also featured the firm in a March story about small businesses nationwide that have gone against overseas manufacturing.

The list of other Gulf Coast companies that have rethought China for a variety of reasons is diverse. It stretches from Fort Myers-based retailer Chico's FAS to Natural Prosthetic Dental Lab, a Bradenton firm that makes digital dental impressions.

Moving challenges

The anti-China movement at Creonix, meanwhile, might have different roots, but it's still key to the company's endurance, says Piela. “I'm excited the company survived,” he says. “People still get to keep their jobs, and our future looks very good.”

Piela and his wife moved to the Gulf Coast from New England in the late 1990s to retire. An accountant by trade, Piela ran or owned electronics manufacturing firms in Connecticut most of his career. He bought his first company when he was 32.

But like many other executives before him, Piela got restless in retirement. Creonix hired Piela in 2004, when the son of the founder ran it. Creonix was founded in 1988.

The company is now owned entirely by KleinPartners. Piela says little publicly about the specifics of what Creonix manufactures or its assembly process. The secretive nature, he says, is both for competitive reasons and because the company has several military projects.

Nonetheless, Piela says Creonix's employees are the backbone of the company's recent successful run because of their ability to adapt to the new business model. Piela says employees, and finding more talented ones for the expected growth spurt, is one of four key challenges to the company's future.

The other three challenges: finding and buying the right equipment; monitoring competition; and cost control. Piela realizes those challenges aren't stationary.

“You are never going to figure it all out,” says Piela. “There will always be another piece of equipment. There will always be new technology coming out.”