- November 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

Business. MagneGas

Industry. Alternative energy

Key. Focusing on one use to maximize revenue.

Ruggero Santilli had big ideas when he emigrated from Italy to the United States in 1967. In fact, contemporaries in his field — physics — labeled some avenues of his research “fringe science,” meaning his theories were unorthodox and widely disputed in the scientific community.

After nearly 20 years of research and development, Santilli patented new technology that applies his so-called “anti-Einstein” theories to create green fuel.

He spent more than $5 million to found MagneGas Corp. in 2007 and after three years of highly variable revenues — and one year of losses — he hopes $3.14 million in new capital and a new president can push the firm to profitability.

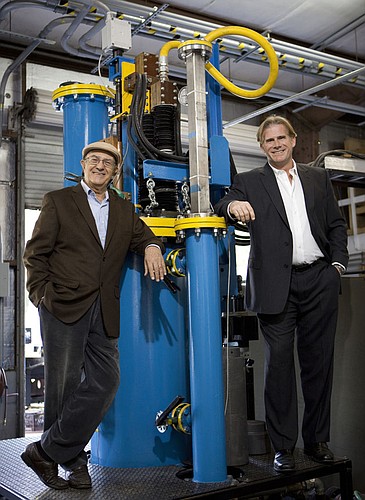

Overseeing the new direction is Scott Wainwright, president of the firm, and CFO Luisa Ingargiola, Santilli's daughter. Wainwright was recruited to the company in 2010 and became president later that year; Ingargiola has been with the firm since inception.

Wainwright says he and Santilli connected right from the moment they met at his interview for the job. “We hadn't even met before, and doc [Santilli] says: 'That's my guy,'” Wainwright recalls.

Wainwright, with a strong entrepreneurial and real estate background, entered as sales manager in 2010. After two inquiries about becoming president, he finally accepted in December that year. “I knew what it was like to run a company,” he says. “It's pretty stressful.”

When the company was founded, it had a broad vision. The technology it produced was used in liquid waste disposal, water sterilization and gas fuel manufacturing. Revenues were irregular and Santilli's wide scope proved to be detrimental.

Wainwright saw the problem immediately: MagneGas needed to focus on it strengths to establish a solid sales stream. “We've got to establish cash flow,” he says. It took him 90 days to persuade the board to accept the new direction, which would be a focus on sales of MagneGas as fuel and the Plasma Arc Flow technology for welding purposes.

'The butterfly effect'

Santilli considers himself the penultimate environmentalist, which is one reason he has spent so much time researching this technology. But he also has a strong patriotic streak — especially for an immigrant whose English was so poor when he arrived in the U.S. that he had a hard time buying groceries.

“We have to reduce our dependence on foreign oil,” Santilli says. Aside from the environment, Santilli believes products like his can help solve economic and financial woes of the country. “It is my deep conviction that the only way to resolve our financial problem is via new technology,” he says.

He developed MagneGas for all of these aims, and many more — he can talk at length about what he believes his technology can accomplish.

The technology works by running an electrical current between two coal coils in the company's patented Plasma Arc Flow system, which the company calls refineries. Waste — which includes everything from used motor oil to farm animal waste — is pumped through the electrical current, creating a hydrogen-rich gas, sterilized water and carbon, depending on the type of waste. The gas, which has become the company's main focus, is called MagneGas.

For about three years after the company was founded, it focused on trying to market the machines to municipalities, without success. “Nobody wants to be the pilot for new technology,” Wainwright says. “And municipalities were broke.”

Another avenue the firm pursued was the sale of the machines for water sterilization purposes. Although they have one machine in China fulfilling this need, which accounted for the firm's largest quarter in terms of revenue, it has still not generated enough revenue to make the firm profitable.

And the disposal of waste, yet another revenue-generating proposal for the firm, contained too many bureaucratic hurdles. “If we want to test even 50 gallons of waste we need to get a permit and have an engineer on site,” Ingargiola says.

The problem: Juggling all of the potential revenue sources wasn't making the firm money. “We call it the butterfly effect,” Ingargiola says. “We were trying to do too many things at once and losing money.”

In what would eventually become the firm's focus, MagneGas began selling its gaseous fuel in 2010. “It was (Santilli's) goal to become a fuel company,” Wainwright says.

Wainwright, who founded a marketing firm called Future Market Inc. in 2001, took this goal and turned it into a new business plan when he became president of MagneGas.

Fuel focus

Wainwright was charged with a difficult task in making a green energy firm profitable without lobbying for government assistance — something the firm has never done. “Most green energy companies are stuck in research and development, living off of grants,” Ingargiola remarks. “We haven't received a penny in grants.”

Despite the ruggedly capitalist approach, the firm still needed to establish a source of income. “We need to show shareholders we can make money,” Wainwright says of his predicament. “So we needed to focus on steady and immediate revenue streams.”

Instead of bending to the Department of Environmental Protection's regulatory standards, Wainwright decided the firm didn't need to process waste to make fuel — and money. He realized that by purchasing anti-freeze new and processing it into MagneGas, the firm could increase its margins.

The company targeted the welding industry, including shipyards and scrapyards, as customers for its fuel, which burns at 5,900 degrees fahrenheit. “We didn't want to challenge the natural gas market as a whole,” Wainwright says. “So we focused on the welding industry.”

The most common gas used for metal cutting is acetylene, which according to research by the EPA emits noxious fumes and is toxic to the end user. Because MagneGas claims it burns four times cleaner than acetylene, the company saw this area as an opportunity to compete.

It could also compete on aesthetics. The company takes its products to potential customers and trade shows to show off the clean edges it leaves when it's used to cut metal, something Wainwright says acetylene can't do.

The company sells cylinders of its gas through distributers or wholesale to customers who pay rent on the cylinders as well as for the gas within. “It has really stabilized revenues,” Wainwright says. Revenues have been stable over the previous three quarters, hovering around $65,000.

However, Wainwright believes the company's new model and the backlog of customers the firm has will be enough to push the firm, which recorded $587,011 in losses the third quarter of 2011 compared with the same period in the previous year, back to profitability by early 2012.

Aside from selling the gas, the company's long-term plans include selling the Plasma Arc Flow refineries that create MagneGas on-site at customers' plants, which cuts the costs of shipping the fuel.

But they may be a bit harder to sell than a $35, 250-cubic-foot cylinder of MagneGas. The 300-square-foot refineries cost between $1.7 million and $2.9 million, according to Wainwright. However, the firm recently shipped one to Michigan for demonstrations, and it is in talks with two automobile manufacturers interested in the machines.

Wainwright and MagneGas are not the only ones betting on future success. A Securities and Exchange Commission report filed Nov. 8 reveals that Northland Capital Services, a Minneapolis, Minn.-based financial services firm, provided $3.14 million in capital to MagneGas. Wainwright says the firm will use it to purchase 3,000 new cylinders to put into rotation for MagneGas customers awaiting availability of the gas.

Like Santilli's theories refuting Einstein's Theory of Relativity, MagneGas still has its detractors, including bloggers and scientific message boards who question the firm's claims. But if the firm generated quarterly revenue of $65,000 with only 200 cylinders in rotation, the addition of 3,000 more could boost the company to nearly $1 million in quarterly revenues.

“This is the future,” Wainwright exclaims. “Our competitors are stuck in the 20th century.”

Ruggero Santilli's vision for MagneGas and its refineries is to reduce dependence on foreign oil, strengthen the country's financial standing and improve the environment. Lofty goals considering there are few vehicles operating on natural gas and the company has recorded more fiscal quarters with losses than gains in net income.

But the push toward selling refineries and fuel may be the first step to the company's ultimate dream: closed-loop systems. A refinery would be sold to an automobile manufacturer. The system would convert used anti-freeze and oil to gas fuel, which would then be used to power forklifts and sundry other vehicles the company uses. “Customers come in for an oil change and the manufacturer gets fuel out of it,” Wainwright says. “Win-win.”