- November 26, 2024

-

-

Loading

Loading

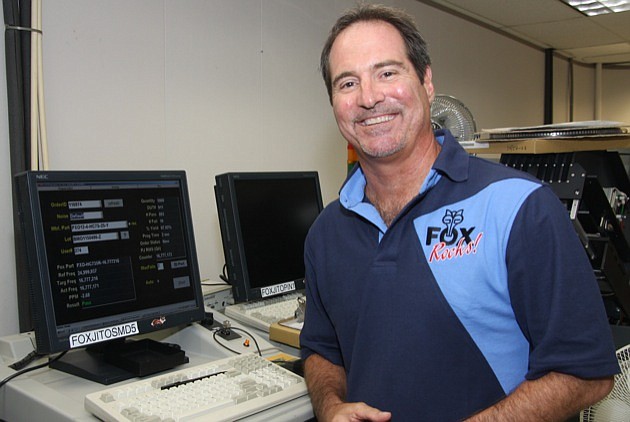

E.L. Fox Jr. always has a good read on what's ahead for the technology industry.

That's because his company, Fox Electronics, makes oscillators that regulate the heartbeat of microprocessors in countless computer devices, from cell phones to servers and computer networks.

When orders start to slow, as they have started to recently, Fox knows it's time to reevaluate every expense and keep a watchful eye over inventory levels. “You learn to look for the signals,” says Fox.

Today, Fox says he's starting to see signs that this most recent technology business cycle may have peaked. “You can see a softening,” he says. “It doesn't go up forever.”

Consumer spending has flattened, China is raising interest rates, Europe is embroiled in a debt crisis and revolution is stirring in the Middle East. “There's an obvious change in the market,” Fox says.

For Fox, one of the key indicators that signals a slowdown is the book-to-bill ratio, when the company is billing more than it's booking new orders. Also, Fox pays particular attention to how far in advance customers order key products, a sign of business confidence.

Fox learned to follow these signals after nearly being wiped out by the tech bust in the early 2000s. Today, inventories are lean, expenses are routinely examined line by line and every manager prepares a quarterly forecast. “The first day of each quarter it becomes gospel,” Fox says. “It takes three months to make a trend.”

Still, Fox isn't certain how long a downturn might last. “It could last six months or a year and a half,” he says.

But a downturn isn't stopping Fox from doing the things he needs to do to build the business and take share from the competition, such as boosting sales efforts in key markets and investing in research and development. These kinds of investments help power companies through downturns and put them in good position when the inevitable rebound occurs.

“We're going to open up an office in San Jose,” Fox says. Despite woes in that state, California still accounts for 22% of the domestic technology market. “You've got to be in the field and close to the customer,” he says. “It's tough to service from Fort Myers.”

For example, the current Fox manager, whose territory includes California, visits customers 20 days a year. With an office in San Jose, the same manager will be there 250 days a year.

Fox also has increased its presence overseas, with offices in China, Canada and the United Kingdom. Europe and Canada have seen good growth, but Fox says Asia has been difficult to break into because of strong ties among well-established companies there.

Fox also says investing in research and development is preferable to spending money defending patents on existing technology. “We're more focused on the next generation,” says Fox. “The idea is to stay ahead.”