- November 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

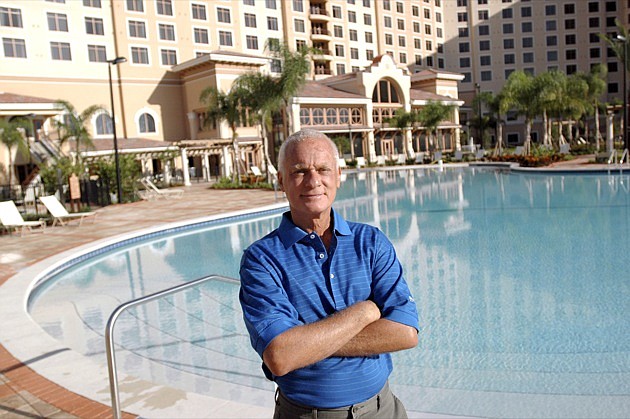

Business. Rosen Hotels & Resorts Inc.

Industry. Hospitalitiy

Key. No debt allows Rosen to expand when others shrink

Harris Rosen knows a thing or two about how to stimulate the economy.

The Orlando hotelier recently completed a $40 million overhaul of his hospitality empire at a time when Central Florida hotel operators are struggling. He's dubbed it the “Rosen Stimulus Package,” and he's not shy about comparing his success to the federal stimulus package.

“We're still waiting on a lot of those federal projects to materialize,” says Rosen, president and COO of Rosen Hotels & Resorts Inc. “Our plan is putting people to work right now, and it's not costing the taxpayers a dime.”

The Rosen Stimulus Package includes renovation of about half of the company's 6,300 rooms, upgrades in landscaping and pool deck areas, new signage, and the installation of low-flow plumbing fixtures. It also includes building a new central laundry facility that will serve Rosen's hotels, as well as several others along International Drive.

Plus, Rosen recently purchased 25 acres next to the Rosen Shingle Creek Resort and plans to add other 500 rooms to the property.

So why is Rosen upgrading and expanding his properties while other hotel operators remained hunkered down?

He has no debt.

His seven hotels — including the $300 million Shingle Creek resort that opened September 2006 — are debt-free.

'Don't owe anybody'

It's a philosophy he developed at an early age. His immigrant grandfathers lost businesses in the Great Depression, and they passed on the lessons they learned.

“They sat me down and told me 'Don't owe anybody anything ever,'” Rosen says. “I don't know why, but that always stuck with me.”

Rosen admits his decision to pay as he goes is foreign to most.

“Our philosophy to be debt-free made little sense to people five years ago,” Rosen says. “The thinking was why use your own money when you can leverage other people's money.”

Rosen has borrowed money on rare occasions, but he pays it off as quickly as possible. He understands that his aversion to debt will not work in every business situation.

Public companies are almost forced to borrow money, Rosen notes, because shareholders pressure management to show immediate and continued growth.

“You have to have patience to run a debt-free company,” Rosen says. “Public companies don't have patience.”

Neither do most entrepreneurs. Patience is not an ingredient in the fuel that drives most entrepreneurs to seize opportunities others dismiss, Rosen says.

“You have to decide whether growth is important to you,” Rosen says. “In the 37 years since I bought my first hotel, I've only grown to seven hotels.”

Granted those seven hotels house 6,300 rooms, nearly 1 million square feet of meeting space and are staffed by some 4,500 employees, making Rosen the largest independent hotel operator in Florida.

Dangerous beginnings

It didn't start out that way. Rosen purchased his first hotel in 1974, when the U.S. was in the midst of an oil embargo, the occupancy rates in Central Florida were about 10% and most Orlando hotels were in financial distress.

“I was too stupid to be afraid,” Rosen says about taking over the 254-room Quality Inn on International Drive. “And I wasn't very smart when I was negotiating the deal. They asked how much money I had in the bank. I told them $20,000, and sure enough, that was exactly what they said the down payment would be.”

Rosen convinced the bankers to allow him to use the hotel's profits to pay off the bank, thus avoiding a loan.

He immediately slashed costs by moving into the hotel and taking on at least a dozen job titles, from director of maintenance to night clerk.

To generate business, he hitchhiked to New England to meet with motor coach companies who regularly brought tourists to Orlando. Meetings usually took place in bars or restaurants, and deals were worked out on cocktail napkins.

“I would ask them, 'What do you want to pay to stay at my hotel?' ” Rosen recalls. “They would quote a rate of $9 or $8 per room. I would write it down on that cocktail napkin and sign it. That was our contract.”

He spent a week meeting with motor coach operators, many who took such pity on Rosen that they would drive him to their competitors for his next meeting. By the time he returned to Orlando, he had booked a year's worth of hotel rooms and developed business relationships with those operators that still exist today.

Within a year, the Bank of Philadelphia approached him about taking over a nearby hotel that many viewed as a lost cause. Instead of agreeing to take on the debt of the previous owner, Rosen offered a unique plan. He would operate the hotel and not charge a management fee. In return, all profits would be applied to the outstanding debt, and, most importantly, the bank would match all profits dollar for dollar. The hotel would belong to Rosen if the debt had been paid off in five years.

He did it in four.

“I got a hotel for 50 cents on the dollar and didn't take on a dime of debt,” Rosen says.

Rosen continued to reinvest in his company, and by the 1980s he and the Central Florida hospitality industry were soaring with the growth of Orlando's convention business and strong leisure vacation market.

Rosen expects the hospitality business will be booming once again, but he's not waiting for others to kick start the economy. As evidenced by the Rosen Stimulus Plan, Harris Rosen is taking matters into his own hands.

“I don't think this is a very business-friendly administration we have in the White House, but this is a very resilient country,” Rosen said. “I'm living proof that you can achieve success. I'm very bullish on America and always will be.”

Running a debt-free company provides Harris Rosen with a lot of opportunities.

During the last two years, Rosen says he has been approached by multiple hotel operators about buying their properties.

“We've been approached by some pretty big names,” Rosen said. “There are some really interesting opportunities out there.”

One of the most intriguing offers was an opportunity to take over the iconic Greenbrier Resort in West Virginia. The resort has hosted 26 U.S. presidents and is the site of a massive underground bunker that was meant to serve as an emergency shelter for the U.S. Congress during the Cold War.

Jacksonville-based CSX Corp. owned the Greenbrier for much of its 153-year history, but it put the resort in bankruptcy in 2009 after the property lost $166 million in 2008.

Rosen says he was offered the chance to buy the resort for $1. The chance to acquire a high-profile property is tempting to many people, but Rosen turned it down because he projected future losses of more than $50 million. In addition, the Greenbrier did not fit his long-established business model.

“Whenever we look at new opportunities we always ask, 'Is this something that will make us better,'” Rosen said. “It would be fun to own the Greenbrier, but I don't think it would have made us better.”

Don't take on unnecessary debt — “Not everyone can do it, and it takes discipline.”

Outwork the competition — When he bought his first hotel, Rosen wore many hats, including short-order cook and head of maintenance. “I saved $200,000 in salaries by doing everything I could myself.”

Treat people with great respect — “Stay humble and don't take yourself too seriously.”

Always be honest — “It keeps everything simple if you're honest all the time.”

Sweat the small stuff — “The details will kill you.”