- November 26, 2024

-

-

Loading

Loading

REVIEW SUMMARY

Business. Biolife, Sarasota

Industry. Medical products

Key. Company hopes to grow sales after a management shakeup.

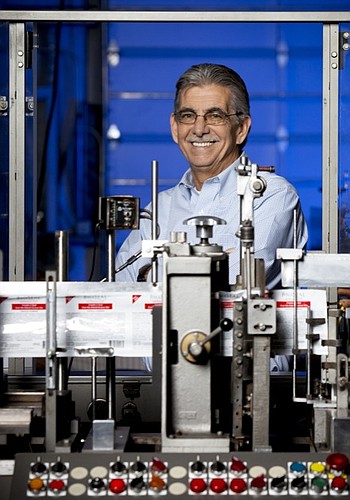

Sam Shake had little to celebrate in late 2008 when Sarasota-based Biolife promoted him from director of operations to president and chief executive.

The recession was on full blast. Sales of the company's core product — a powder that can stop bleeding and control wounds — were in the dumps. Morale at the 30-employee company was suffering.

And that was just the first week. In Shake's first six months on the job, the company went into an even deeper sales slump. That itself was a frustration, since the company's distributors were up 35% through the first half of 2009.

“They weren't buying from us,” concedes Shake. “They were doing it through inventory reduction.”

Biolife, founded in 1999, also presented an historical conundrum for Shake: Its products had almost always been well received in the marketplace, yet sustained sales success rarely followed the rave reviews.

“We've never been very successful on the financial side,” says Shake. “That's always been a struggle for us.”

Shake, however, had an ambitious and pinpoint strategic plan to turn around Biolife almost from his first day as CEO. A former quality director for the largest division at the Pillsbury Co., Shake was convinced that the power of Biolife's powder held a giant opportunity that was barely being squeezed.

Shake's mission was to launch both a cosmetic and a functional rebirth of the company. Charles Entenmann, a retired baked goods magnate who owns Biolife, approved the plan.

One of the first makeover steps was taken when the company rewrote its mission, vision and values — a lengthy process. It was crucial to take that step first, says Shake, to regain trust and faith in the employee base.

The step was also practical. The company's new mission, vision and values statement replaces what was known as the Biolife Way — a plaque hanging on a wall that listed eight company beliefs. “For any of this to work,” says Shake, “it has to be more than just a plaque on the wall.”

The results of the company transformation are already being felt. Morale is up and so were sales in the latter half of 2009. Shake declines to release specific annual revenues, only to say that it's currently under $5 million, with plans to double the figure by 2011. The firm also hopes to go from 30 to 50 employees within the next two years.

Biolife is scouting possible new office space to meet its projected demand. It currently operates out of about 25,000 square feet of leased space near the Sarasota-Bradenton International Airport. While Shake says the company is still at least 18 months from outgrowing the space, the rock-bottom low commercial real estate prices in the area make it appealing to buy now.

“Yesterday was the best day to be doing all this, as far as I'm concerned,” says Shake. “That's how good this product is.”

Key moments

After a rewrite of its mission, vision and values, Biolife, for the first time in its history, came up with a strategic plan that peered ahead three years. That process took six weeks, involved every employee and was occasionally painstaking, but Shake says it “will go down in Biolife history as a key moment.” (See related story.)

But that's just one of several recent key moments that holds the potential to shake up the company.

Biolife recently partnered with new sales teams, which helped expand its national sales scope from four people in 11 states to more than 25 people spread nationwide. And last summer it hired Dr. G. Duncan Finlay, the former president and CEO of Sarasota Memorial Hospital, as its part-time chief medical officer.

Finlay, who retired from SMH in 2005, was introduced to the company through a friend and says he was immediately impressed with the product. He now helps Biolife's researchers and sales staff work together to bring a viable product to the marketplace.

“My role,” says Finlay, “is to make sure there is a sound medical basis for the claims we make.”

Biolife also recently brought on several new executives, including one to monitor regulatory compliance, another to head up national sales in the health care market and a third person to supervise sales for first aid products.

Finally, Biolife renamed and rebranded its core products. The company's mainstay consumer product, what used to be called QR, for Quick Relief, is now WoundSeal. What was Pro QR, sold mostly in hospitals and medical facilities specializing in vascular procedures, is now BioSeal.

“Turns out no one knew what the heck [QR] stood for,” says Shake. “You'd walk down the aisle and have no idea what it did.”

And Shake says that was unfortunate, because the products have always been unique in the ability to stop bleeding, something Biolife customers constantly brag about. The powder is made up of a hydrophilic polymer and potassium ferrate that creates a scab upon instantly touching blood. That seal stops the bleeding, seals the wound and creates a microbial barrier around the wound that protects against infections.

Good news

The combination of accolades and struggling sales has followed Biolife like a late-day shadow for almost a decade. Indeed, the company won the Review's Technology Innovation Award in 2003 for its products, which, back then, were sold mostly in the sports medicine industry.

The company was founded in 1999 when James Patterson, a then 78-year-old scientist in Sarasota, was exploring ways to purify drinking water. Patterson accidently cut himself on a sharp piece of glass and his hands were quickly coated with the potassium salt he was tinkering with.

The stunning good news to the diabetic Patterson: The chemicals clotted his blood and formed a hard scab seconds after the grains entered the wound. It usually took at least 20 minutes for Patterson's blood to clot.

Patterson soon joined forces with John “Alf” Thompson, a Sarasota chemist and friend. Thompson's father-in-law is Entenmann, who took over his family's bakery business in Brooklyn, N.Y. in 1951 when he was 22 years old.

Entenmann and a few other investors provided funds for Biolife's initial research stage, which lasted until 2001. Shake joined the company as director of operations in 2004 and he brought his corporate experience from two decades at Pillsbury with him. In between Pillsbury and Biolife, Shake co-founded Leadershift International, a consulting firm that worked with companies on leadership issues and on how to build a successful mission, vision and values statement.

In Shake's first four years, however, Biolife mostly hovered in neutral when it came to sales growth. Entenmann decided to make a leadership change in late 2008, when he replaced former CEO Doug Goodman with Shake.

Entenmann, who lives part of the year in Florida, couldn't be reached for comment on the management shakeup.

Stats and data

Shake, now more than a year into the new leadership role, says 2010 should be a pivotal year for Biolife. This is the year, he says, when the company makes the leap from strategy to execution in many areas.

One way Shake hopes to lead the execution is through an attitude change. For instance, he says the approach when talking to potential clients should go from “please take a look at our products” to “you need to take a look at our products.”

On that vein, Shake is also trying to foster an atmosphere where data and statistics take precedence over gut feelings and intuition. The company has relied on the latter too often, says Shake.

Another lingering challenge is one faced by many companies that have a cool product but cold sales: access to decision-makers. In Biolife's case, at least in the medical products market, that would be hospital administrators. The company hopes Dr. Finlay will be the key to unlocking those doors.

“It's not easy to get a product into hospitals,” says Shake. “The skepticism hits you right between the eyes.”

One more challenge looms: competition. While no company down the street is doing what Biolife does, the threat comes from giant medical companies, such as Johnson & Johnson and 3M.

“Sooner or later,” says Shake, “someone from one of those companies is going to say 'what the heck is going on there?'”

Mission Underway

Sam Shake led Sarasota-based Biolife on several 'first ever' missions in his first six months as chief executive last year. Now the those will be put to the test.

But Shake, a former high-level manager with the Pillsbury Co., says one of his most important tasks was when he helped the 30-employee firm create a strategic plan, something it had never done before. Having now gone through it several times with Biolife and other companies, Shake says the strategic plan process is essential for any company, regardless of size, niche or mission.

And the recession has only heightened the necessity of creating a well-thought out strategic plan. Says Shake: “There was a direction and purpose that was missing here.”

The strategic plan process at Biolife took six weeks. “It was relatively new to most of the people,” says Shake.

The initial parts of developing a strategic plan, says Shake, are relatively simple. The first step is to do a SWOT analysis, where a company probes its strengths, weaknesses, opportunities and threats. That includes looking into external forces, such as the economy and the labor pool and internal forces, like technology and employee benefits.

The next step, says Shake, is to “leverage what you have and fix what you don't.” After that, it's time to turn strategies into objectives and platforms into ideas.

At Biolife, the strategic plan process produced four strategies, 14 objectives and 64 initiatives.

The final step is where many companies stumble: execution.

Biolife is currently in the execution phase of its first strategic plan. Says Shake: “This is the level where you can put ownership on the initiatives and hold people accountable.”

Mark Gordon covers the Sarasota-Manatee region. He can be reached at [email protected], or 941-362-4848.