- December 13, 2025

-

-

Loading

Loading

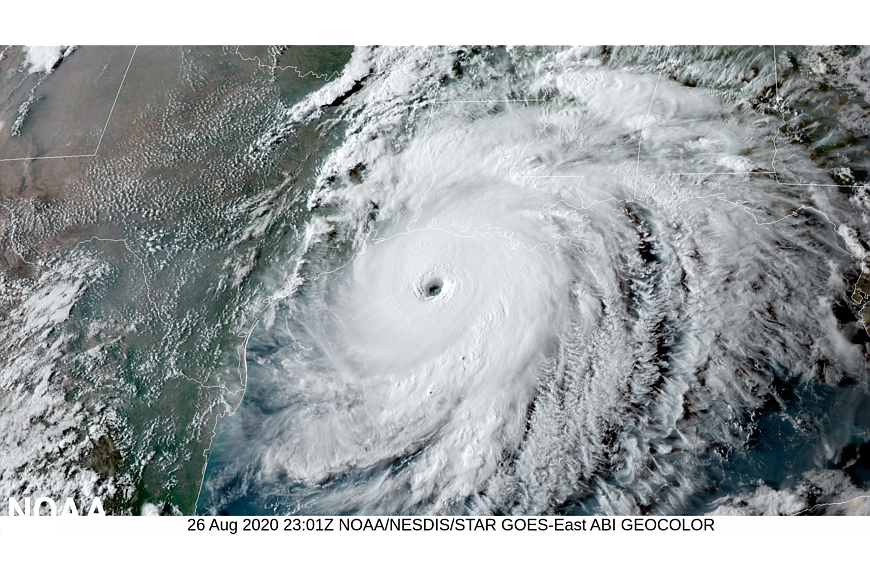

State legislators will reconvene in Tallahassee on May 23 for a special session on property insurance.

Gov. Ron DeSantis set the dates for the session in a proclamation that says the state needs “to act to stabilize the insurance market for Florida policyholders before the 2022 Atlantic Hurricane Season.”

The session will run through May 27.