- November 24, 2024

-

-

Loading

Loading

PASCO COUNTY — A company with ties to a payment processing business in California has entered into an agreement to buy a majority interest in Florida Bancshares Inc. and First National Bank of Pasco.

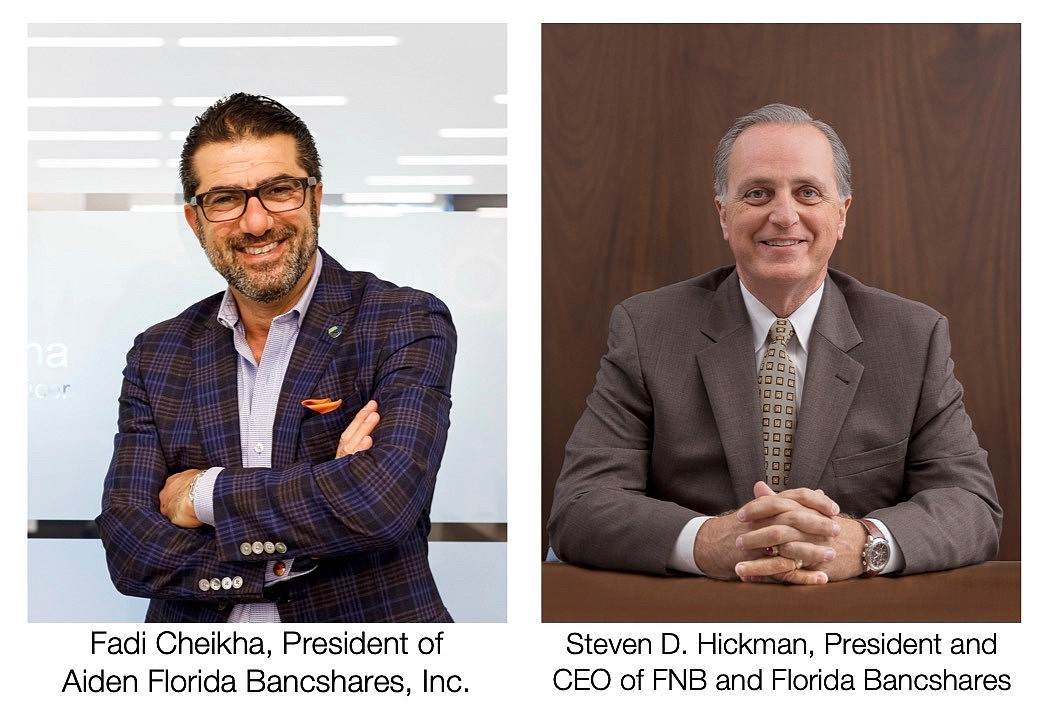

The company is called Aiden Florida Bancshares. According to a filing with the Florida Division of Corporations its address in Rancho Santa Margarita, California matches that of payment processor US Alliance Group. A press release announcing the sale quotes Fadi Cheikha and refers to him as president of Aiden. Cheikha is the founder and CEO of US Alliance Group.

A company spokesperson says in an email that "USAG is not buying a majority share in the Florida Bancshares of First National Bank of Pasco, Aiden Florida Bancshares is."

"Aiden Florida Bancshares shares office space with USAG. Our founder owns many unique companies that are not connected or related to each other."

Cheikha, in the press release, says Aiden is “eager and excited” to join forces with Florida Bancshares and “to expand the product offerings to its customer base.”

“The knowledge and experience our principals bring to this relationship will aid in the growth of First National Bank of Pasco.”

First National Bank is a subsidiary of Florida Bancshares. According to the release, Aiden is buying 65% to 85% of the outstanding shares of Florida Bancshares for a price equal to 1.9 times its adjusted book value per share. That value will be based on “shareholders’ equity as of the month-end prior to the closing date of the transaction, to be adjusted for certain expense and income amounts incurred, divided by its fully diluted common shares outstanding.”

The closing is subject to regulatory approvals and all employees will stay, according to the release.

First National Bank has $275 million in total assets according to the Federal Deposit Insurance Corp. The bank employees 49 and has five branches.

Steven D. Hickman, president and CEO of First National Bank and Florida Bancshares, says in the release when the sale is complete, the bank “will be poised to continue growing its commercial banking franchise as well as benefit from tremendous fee income opportunities generated from (financial technology) businesses.”

Hickman will stay on as president and CEO.